The total amount of student loan debt in Canada is pretty staggering. Estimated to be well over $20 billion as of 2022, equivalent to 1.8 million students owing the government an average of over $13,000.00 each.

These loans are backed by the federal and provincial governments, providing students with an essential lifeline to complete their studies. Amazingly, the federal government has permanently eliminated national student loan debt interest as of April 1, 2023. However, some students still opt for private lender-issued credit lines to finance their education.

Canada Student Loans are Normal for Canadian Students

50% of students aged 18-24 use Canadian student loans.

No matter how you fund your education, you may need to use credit or loans. For many, student loans are their first experience borrowing money.

Understanding the National Student Loan Service Centre (NCLSC), how federal and provincial loans work, what you should spend the money on, and how you’ll eventually repay the debt is critical. Hopefully, this article will provide more insight into student loan living and enable you to make wiser financial choices.

What is a Student Loan?

Student loans in Canada are provided by the government. They help students cover tuition, books, living expenses, and other education-related costs. These loans are available for post-secondary studies.

Loans are available with low-interest rates and flexible repayment terms. This makes it easier for students to focus on their studies without worrying about a heavy debt burden.

Canada Student Loans in Canada

Government-funded student loans are a good way to access funds for higher education. However, they may not be the most cost-effective or the best choice.

Creditpicks

The Government of Canada provides a loan program to help support students nationwide. This loan is independent of the available provincial funding and can be accessed and managed using the National Student Loans Service Centre. The website and your student aid account are excellent resources for managing money and keeping track of loan and payment plans.

It is possible to combine Federal and Provincial loan applications and repayments. Although each province has different rules and regulations, this guide will provide a general overview. It is essential to investigate the specific requirements of your province.

Government-funded student loans are a good way to access funds for higher education. However, they may not be the most cost-effective or the best choice. However, this may be the only viable option if you or your parents do not have good credit.

Federal Student Loan Interest Rates

As previously mentioned, the Government of Canada permanently eliminated interest on federally-held student loan debt on April 1, 2023. This means that the federal portion of your student loans is interest-free.

You begin repaying your loan six months after completing your program of study, whether you graduated or not. Your loan, repayments, and other related concerns, such as a Repayment Assistance Plan, are managed by accessing the NSLSC website.

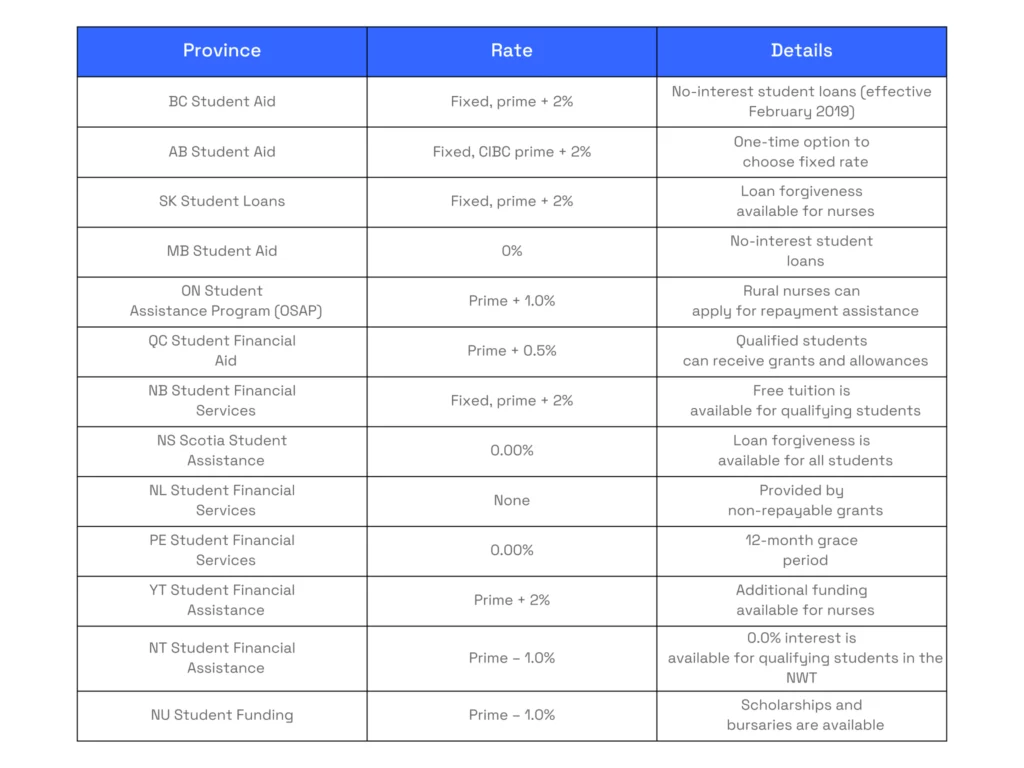

Provincial Student Aid Interest Rates

Each province has its own system for dealing with its portion of a student loan. Depending on the province, you may need to apply for the federal portion of the loan with the provincial part.

Certain provinces, such as Manitoba, offer 0% interest on their part of government-funded student loans. Manitoba has one of the lowest tuition fees in the country. Other provinces like Alberta have a higher interest rate based on the prime rate.

Most provinces offer financial aid programs such as grants, bursaries and special circumstances applications. These can help cover tuition and other expenses. These programs are typically tailored to those who have dependents, come from low-income households, or have other special circumstances.

How do I Apply for a Student Financial Aid?

Applying for a student loan in Canada involves several steps, which may vary slightly depending on your province or territory. Here's a general guide to help you through the process:

Determine Your Eligibility for Canada Student Loans

To qualify for a student loan in Canada, you must be a Canadian citizen, permanent resident, or protected person. You must also be enrolled in an eligible post-secondary institution and demonstrate financial need.

Research Your Provincial or Territorial Student Financial Assistance Program to Canada Student Loans

Each province or territory administers its student loan program, so you must research your region's specific requirements and application process. Some provinces and territories have integrated their loans with the Canada Student Loans Program, while others maintain separate systems.

Gather Necessary Documents

Gather important documents before applying. These documents include your Social Insurance Number (SIN), proof of enrollment, and financial information. Examples of financial information include tax returns, bank statements, and proof of income. You may require related information from your parents.

Apply Online

Most provinces and territories offer online applications for student loans. Visit the official website of your provincial or territorial student financial assistance program and follow the instructions provided. You must create an account, complete the application form, and submit the required documentation.

During the application, you'll likely be able to apply for other provincial scholarships and awards. For more information, contact your student aid service centre.

Assessment and Notification

After submitting your application, it will be assessed to determine your eligibility and the amount of financial assistance you can receive. You will be notified of the decision through your online account or by mail.

Accept Your Loan Offer

You'll receive a loan agreement or certificate if your application is approved. Visit your NSLSC account, review the terms and conditions, accept the offer, and submit the required documents to finalize the process.

Receive Funds

Your student loan funds will typically be disbursed directly to your post-secondary institution to cover tuition and fees. Any remaining funds will be released to you for other education-related expenses.

Check your provincial or territorial student financial assistance program's website regularly. Look for updates, deadlines, and extra information about the application process.

Why Do I Need My Parents' Income Information?

If you recently graduated from high school, you may need to provide your parents' annual income. This is to determine if you are eligible for a student loan from the government. To do this, you must submit their tax return(s) from the prior year.

After a certain number of years following high school, you are known as a mature student. You do not need to include your parents' income when applying for financial aid. This varies according to federal or provincial programs. This can possibly result in more financial assistance, especially if you have dependents and are paying rent.

If you are under the age of a mature student and find yourself in an unfavorable position, like having an estranged relationship with your parents, it may be possible to provide proof of the situation to those who are evaluating your application.

What is the Processing Time for Canada Student Loans in Canada?

The processing time for student financial aid decisions in Canada can vary depending on the province or territory, the specific financial aid program, and the time of year. Generally, it takes 4-6 weeks for your application to be processed and for you to decide. However, processing times may be longer during peak periods, such as before a new academic term starts.

Submit your application and all required documentation early. Do this as soon as possible and before the deadline. This will help ensure a timely decision.

Regularly check your online account or visit the official website of your provincial or territorial student financial assistance program. By doing so, you can easily stay informed and receive timely updates about your application status.

Remember that the funds' disbursement may take additional time after you receive a decision. Therefore, it's crucial to plan your finances accordingly and consider the potential delays in receiving your financial aid.

How much money will I receive?

The amount of money you can expect to receive in a loan depends on many elements. Generally, the loan amount should be enough to cover the cost of tuition at your college or university. Other elements that can impact the loan amount include things that can increase or decrease the loan amount.

- Whether you require student housing or off-campus housing (if you’re living at home with your parents and not paying rent, this won’t apply to you).

- Your parents’ annual income.

- Your annual income.

Your financial situation will be assessed to determine your required funding if you are an adult student. Having an RESP or savings can reduce the necessary loan amount.

How Can I Spend Student Loan Money?

In Canada, student loan money is intended to help cover the costs associated with pursuing post-secondary education. You can use the funds from your student loan to cover various education-related expenses, including but not limited to:

- Tuition fees: Student loans can help cover the costs of your post-secondary program's tuition fees, typically your most significant education-related expense.

- Books and supplies: Your student loan can be used to purchase required textbooks, course materials, and supplies necessary for your studies.

- Living expenses: Student loans can help cover housing expenses, such as rent or residence fees, utility bills, and groceries.

- Transportation: Loan funds can be used to cover commuting costs to and from school, including public transit passes or expenses related to using a personal vehicle.

- Personal expenses: Student loans can also be used for personal expenses that may arise during your studies, such as clothing, personal care items, or cell phone bills.

- Childcare: If you have dependents, your student loan can help cover childcare costs while you're attending classes.

- Study-related equipment: Your loan can be used to purchase study-related equipment, such as a laptop or other necessary technology.

It's essential to use your student loan funds responsibly and prioritize expenses related to your education. Misusing your student loan can lead to financial difficulties later on and jeopardize your ability to access financial aid.

Paying Back Your Loan

Paying back government student loans in Canada is essential to achieving financial stability after completing your higher education. With flexible repayment options, customized payment plans, and accessible resources, managing student debt has never been easier.

Understand Your Grace Period

After graduating, leaving school, or switching to part-time studies, you'll typically have a six-month, interest-free grace period before loan repayment begins. Use this time to plan and prepare for upcoming payments.

Check Your Loan Details

Review your loan agreement or access your online account to find crucial information such as the interest rate, outstanding balance, and payment due date.

Choose a Repayment Plan

Government student loans in Canada offer flexible repayment options, including fixed and floating interest rates and standard and extended repayment terms. Select a plan that best fits your financial situation and goals.

Set up Payments

Register for an online account with the National Student Loans Service Centre (NSLSC) or your provincial loan provider to manage your loan and set up automatic payments. Ensure your banking information is up-to-date to avoid missed payments and penalties.

Make Additional Payments

If you're financially capable, consider making extra payments or increasing your monthly payment amount to reduce your loan balance and save on interest costs.

Seek Repayment Assistance

If you're facing financial difficulties, explore the Repayment Assistance Plan (RAP), the Canadian Student Financial Assistant Program (CFSA Program), or other relief options available through the government. These programs can provide temporary relief or help tailor your repayment plan to your current financial situation.

Stay Informed and Proactive

Regularly monitor your loan status, keep track of payment deadlines, and communicate with your loan provider to ensure a smooth repayment experience.

A Bank Student Line of Credit is an Alternative

A bank student line of credit in Canada is a versatile financial solution designed to help students manage higher education costs such as the following:

- Tuition fees.

- Textbooks.

- Living expenses.

- Other education-related expenses.

With competitive interest rates, convenient access to funds, and repayment flexibility, a student line of credit provides revolving financial support.

Unlike traditional loans, a student line of credit allows you to borrow funds up to a predetermined limit, only paying interest on the amount you use. This revolving credit feature offers financial flexibility, as you can draw funds as needed during your studies and repay them at your own pace.

Is a Student Loan or Bank Student Line of Credit Better?

Government student loans are often considered a better option for most students due to the interest-free period, repayment assistance options, and tax-deductible interest. However, if you're ineligible for government loans or need additional funding, a bank student line of credit can provide the necessary financial flexibility.

Working to Finance Your Education is an Option

To minimize your student loans or line of credit, you always have the option to work full-time or part-time while studying. Though this requires you to closely manage your time, lowering your debt burden means financial freedom sooner than later in life. Carefully consider your options; you may use one or a combination of all of the above financing ideas to pay for your education. It is entirely up to you.

Where Can I Find More Information Regarding Provincial Student Assistance?

The following table lists the website for all provincial and territorial student aid programs.

Conclusion

There are many factors to consider when deciding whether you'll use government student loans to finance your education. Remember, readers are leaders and education usually leads to higher earning outcomes. As such, taking on debt for education likely makes sense in most instances.

Managing student loans or bank lines of credit debt is normal in Canadian life. Being able to efficiently manage the outstanding balance will enhance your financial well-being. If you found this post helpful, subscribe to our email list to get a free copy of our personal finance e-book and get first access to new posts and updates!