What is Blockchain Technology?

If you’ve followed the news in the past five years, you’ve probably heard the term “blockchain” thrown around, along with “Bitcoin” and “cryptocurrency” in Canada. This new asset class has seen frenzied buying and selling activity and has polarized the opinions of investors worldwide. But, what exactly is blockchain technology? If you’re not entirely in tune with technology, don’t worry. Blockchain technology is a straightforward concept to grasp.

A Database, Or not

Simply put, blockchain is akin to a type of database. Most people can grasp that a database is one where data is organized in a particular way on a digital or hardware platform, like a computer. You can then think of blockchain as a database that stores data relevant to it on a computer. The term “blockchain” originates from the slight difference in how this database houses its information. “Blocks” store the information and are then “chained” together.

Blocks and Chains

A block can only contain so much information. A new block forms when the previous block reaches capacity. The types of data stored in each block can be virtually anything. However, the most common data set in these blocks is ledger transactions. The previous block and the new block are linked together by a chain. Such a novel data storage approach helps give the blockchain blocks a chronological order. A better way to think of this is to imagine a freight cargo train. These trains usually consist of railcars and are linked together in a chain. Each railroad car in this freight train can only contain so much cargo before the next railcar in the train starts to get the next batch of freight, and so on.

Decentralization

What sets blockchain technology apart from other databases is its decentralized nature. The data in each block is incorruptible and irreversible. If a user has made a mistake, they cannot undo it and take it back per se. However, because each transaction is on record, the other party, and any other party for that matter, will be able to see the transaction. And since it is an entirely decentralized platform, the blockchain is essentially a public record of all transactions viewable by anyone.

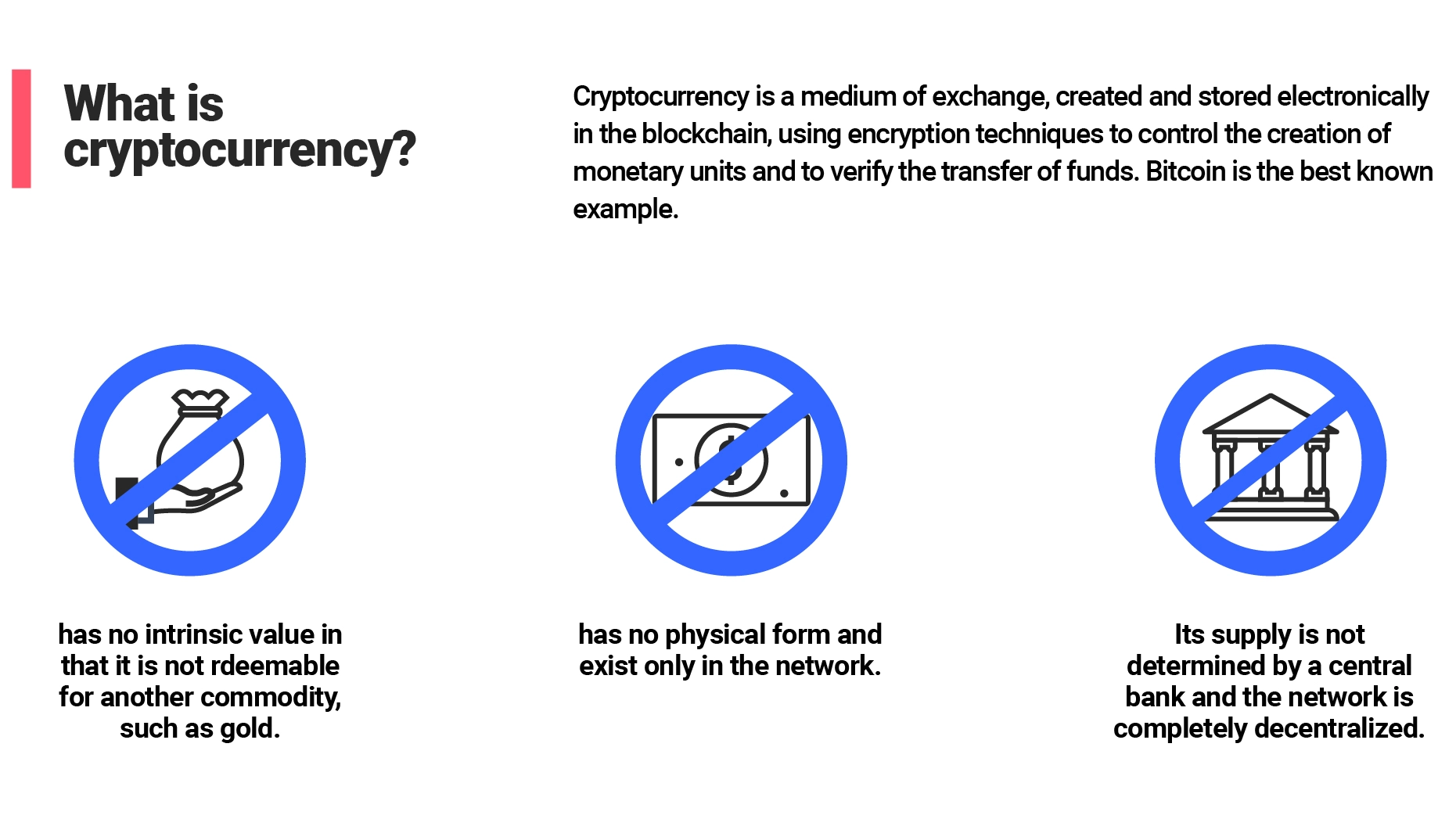

Is Cryptocurrency used in Canada?

In the same way that one Canadian dollar is a medium of exchange between two parties, cryptocurrency in Canada is also an exchange form. Crypto is an intangible (non-physical) digital asset. This non-physical aspect is the most significant difference between crypto coins or tokens and fiat physical currencies such as the Canadian dollar. The “crypt” in cryptocurrency comes from the encryption techniques used to control its use in the network because it is something that you cannot hold or feel and is a digital mode of exchange. It prevents cryptocurrencies from being manipulated, duplicated, or altered, and this cryptography property cannot be understated.

There are thousands of different cryptocurrencies today, with the most popular one being Bitcoin. Thanks to its essentially disruptive nature and the growing worldwide digital trends, Canada’s interest in cryptocurrency has exploded over the past decade. As a result, the idea of a Peer-to-Peer (P2P) financial transaction that cuts out the traditional middleman (banks) to facilitate these transactions has quickly grown in popularity.

Cryptocurrency P2P transactions happen almost instantly. In addition, the cost of running these transactions is a fraction of what you would typically pay a bank, which is another crucial feature of cryptos. Cryptocurrencies like Bitcoin and Ethereum have also grown in utility. As a result, cryptocurrency prices have since risen dramatically, and institutional investors have warmed to the idea of investing.

Always Beware

As attractive as some cryptocurrencies in Canada are, many out there are not what they seem to be. Since it is a highly unregulated industry, countless cryptocurrency scams have robbed early investors of money. Some of the more significant criticisms of cryptocurrencies also include the fact that there are no names or identities behind transactions. As a result, they are conducive to criminals conducting illegal activities and transactions.

You should first perform extensive research and due diligence before investing in any cryptocurrency in Canada. Ensure you understand what you are investing in, and evaluate whether it is worth the risk and potential monetary loss.

Main Cryptocurrencies in Canada

Within the world of cryptocurrencies, you need to know that there are literally thousands of different cryptocurrencies, with many more on the way. However, despite the vast enormity of “coins,” there is a handful that has withstood the short test of time to display their dominance within the cryptocurrency market.

Bitcoin (BTC)

Bitcoin is the king of all cryptocurrencies. It has taken the investing world by storm over the past five years. Bitcoin has also taken investors on a wild ride of massive highs and crashing lows during that time. From either your parents wanting to know how to buy it to your friends asking what it is, Bitcoin has become synonymous with what people associate with when they think of cryptocurrency in Canada.

Bitcoin came into existence in 2008 with the creation of a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The author of this whitepaper used the pseudonym Satoshi Nakamoto, and he is widely considered the “inventor” of Bitcoin. In this short whitepaper, Nakamoto discussed his vision for a decentralized payment system – one that is free from any interference from external influences.

The whitepaper articulated his vision for transactions carried out on an unalterable blockchain where the primary source of exchange is this digital coin, called Bitcoin. This form of Peer-to-Peer transaction can be accomplished by anyone with an internet connection and essentially cuts out the traditional middle party such as a bank. Furthermore, this P2P transaction capacity means the savings of fees one would have to pay for the sender and receiver of the Bitcoin if they had transferred money through more conventional banking methods.

The book "The Bitcoin Standard" by Saifedean Ammous adelves into the history of money and the evolution of a currency, exploring Bitcoin's potential to reshape global financial as a currency and a store of value. Many wealthy investors are starting to add Bitcoin to their portfolios for long-term wealth accumulation. They argue that Bitcoin has all the properties to become the next global currency reserve as it is a superior store of value compared to fiat. As of 2024, there is a continuance of increased global adoption for Bitcoin as the price exceeded $70,000, and the SEC approved Bitcoin spot ETF's on January 10, 2024.

We discuss how to move and store Bitcoin in the following sections.

Bitcoin in Canada

Bitcoin is the largest and most dominant cryptocurrency. No other cryptocurrency in Canada comes close to wrestling away its number one status. Bitcoin’s volatile price movements often affect the rest of the cryptocurrency market. To give you an example of Bitcoin’s sheer size, it has a market dominance of 40-70%, meaning that the total value of Bitcoin has historically comprised up to 40-70% of the entire cryptocurrency market.

Bitcoin has gone from a progressive way of exchanging money to becoming more of a store of value, much like gold has become a store of value for investors. The only caveat is that Bitcoin is much more prone to outsized price fluctuations, as evidenced when its price touched $20,000 in December of 2017 only to watch it crash back down to below $6,500 only two months later.

HODL (or, HOLD)

While it is an exciting time for Bitcoin, investing in it is not for the faint of heart. If you’re not someone who can withstand significant daily price movements, then this investment might not be for you. However, if you are a long-term investor and your risk appetite is slightly higher than some, Bitcoin might be an investment you want to explore. Just HODL.

Ethereum (ETH)

If Bitcoin is Batman, Ethereum is Robin. Ethereum has long lived in the shadows of Bitcoin and has always maintained its number two status behind Bitcoin in terms of market cap. Ethereum is blockchain technology, like Bitcoin. It uses Ether as its form of digital currency.

Bitcoin is a low-cost means to transfer money between two parties. However, Ethereum is different in its scope and capabilities. The most significant difference is that Ethereum is essentially a private network. This architecture has a coding language, and users are free to create projects and applications on the Ethereum blockchain.

Smart Contracts

The heart of the Ethereum blockchain is the concept of smart contracts. In its simplest form, a smart contract is just computer code written by developers on the Ethereum network that lays out the framework or the conditions of an agreement. When a smart contract runs on the Ethereum blockchain, specific requirements are triggered, and the contract terms are delivered. Other parties cannot alter or interfere with this smart contract given the contract’s coded conditions.

Decentralized Applications (Dapps)

The most remarkable thing about the Ethereum blockchain is that it gives developers an outlet and a platform to create decentralized applications called Dapps. This development capability is vital because these Dapps offer users different outlets to transfer money between peers. However, the most vitally important aspect is that these Dapps cannot be controlled or manipulated by any person or group, thus ensuring its complete autonomy.

Ethereum (ETH)

Ripple is the company and the network’s name behind their token, XRP. It is a bit different from Bitcoin and Ethereum in that its network provides a “frictionless experience” when settling digital payments and currency exchange.

The Ripple network helps produce exchanges between fiat currencies (e.g., CAD to USD), cryptocurrencies, and commodities like gold or silver. Ripple token holders are charged a minuscule XRP fee for transactions. This smaller fee sets it apart from Peer-to-Peer transactions on the Bitcoin blockchain, which can be rather expensive.

Transactions at Speed

Another feature of the Ripple network is the almost instantaneous nature of the transactions, which distinguishes it from Bitcoin. In addition, XRP is already pre-mined. This measure ensures it consumes significantly less energy than heavy mining in the Bitcoin blockchain.

Much like Bitcoin and Ethereum, XRP has maintained its status as one of the largest cryptocurrencies, marked by its top 10 positions in market cap over the years. Credible cryptocurrency exchanges in Canada allow you to buy or sell XRP.

Decentralized Applications (Dapps)

The most remarkable thing about the Ethereum blockchain is that it gives developers an outlet and a platform to create decentralized applications called Dapps. This development capability is vital because these Dapps offer users different outlets to transfer money between peers. However, the most vitally important aspect is that these Dapps cannot be controlled or manipulated by any person or group, thus ensuring its complete autonomy.

Tether (USDT)

Although not technically a cryptocurrency people invest in, Tether has become an incredibly valuable “crypto” for many people. Tether is a “stable coin,” meaning that for every single Tether (USDT) out there, there is a corresponding single US dollar. The purpose of stable coins is to try and keep the often wild price fluctuations of cryptocurrencies relatively stable.

Many traders choose to leverage Tether to avoid large fluctuations in the price of cryptocurrencies, most notably Bitcoin. For example, let’s say you’ve seen the price of Bitcoin fluctuate up and down by $10,000 for weeks, and these wild swings are just too much for you to take. Instead, you can trade your Bitcoin into USDT and keep your money there while the price of Bitcoin attempts to calm down. Since one Tether is permanently pegged to one US dollar, the exact amount your Bitcoin is worth in US dollars is what you’ll end up receiving if you convert it to Tether. If the price of Bitcoin falls, you can choose to repurchase your Bitcoin at a much lower cost with your Tether tokens.

USDT Legal Issues

Although not technically a cryptocurrency people invest in, Tether has become an incredibly valuable “crypto” for many people. Tether is a “stable coin,” meaning that for every single Tether (USDT) out there, there is a corresponding single US dollar. The purpose of stable coins is to try and keep the often wild price fluctuations of cryptocurrencies relatively stable.

Many traders choose to leverage Tether to avoid large fluctuations in the price of cryptocurrencies, most notably Bitcoin. For example, let’s say you’ve seen the price of Bitcoin fluctuate up and down by $10,000 for weeks, and these wild swings are just too much for you to take. Instead, you can trade your Bitcoin into USDT and keep your money there while the price of Bitcoin attempts to calm down. Since one Tether is permanently pegged to one US dollar, the exact amount your Bitcoin is worth in US dollars is what you’ll end up receiving if you convert it to Tether. If the price of Bitcoin falls, you can choose to repurchase your Bitcoin at a much lower cost with your Tether tokens.

Top Cryptocurrency Exchanges in Canada

If you’re still deciding which cryptocurrency in Canada to buy but aren’t sure where to buy it or where exactly you should keep them, you’ll be glad to know that there are plenty of top cryptocurrency exchanges in Canada from which to choose. A cryptocurrency exchange is akin to a brokerage firm. You can facilitate the purchase of cryptocurrencies and exchange them between different ones. In addition, it allows you to hold your cryptocurrencies in your account, much like you would hold stocks in your brokerage account.

While cryptocurrency exchanges are a convenient way to purchase and store cryptocurrencies, they are susceptible to being hacked. And, over the past few years, numerous hacks have taken place on crypto exchanges. Despite this vulnerability, crypto exchanges remain a good and trustworthy place to both trade and hold your cryptos. Here are a few of the more reputable names in the industry. For a reliable ranking of the top cryptocurrency exchanges in Canada, check out CoinMarketCap’s exchange rankings.

Binance

Binance is one of the largest and most popular cryptocurrency exchanges in Canada. As with many other crypto exchanges, Binance is relatively new, founded in only 2017. However, it is known for the vast number of “altcoins” traded on its platform. Adding and delisting coins and tokens on Binance is common. We highly recommend checking Binance first if you have an interest in trading a specific altcoin.

On top of its incredible selection of trading pairs, Binance also has its namesake token, the Binance Coin (BNB). BNB can be used to pay for trading fees on the Binance platform. It is also used as a trading pair, but only on the Binance exchange. You’re free to hold and store any cryptocurrencies supported by this trading platform. Each registered user on Binance has a wallet to keep all their coins.

Binance is always striving to ensure that the funds in their customers’ wallets are safe and secure and are always looking for ways to improve their platform offerings. As a result, users on the Binance platform can now stake their coins to help secure the various blockchain networks. In return, users can expect to receive small rewards – often in the form of that specific cryptocurrency.

Coinbase

One of the downfalls of Binance is that it can be an overwhelming crypto exchange for people that aren’t familiar with exchanges or are just very new to cryptocurrency investing. That is why many people turn to Coinbase as their primary crypto exchange.

Coinbase is by far the most intuitive and user-friendly cryptocurrency exchange platform available. Its interface is enjoyable and easy to navigate. It makes purchasing cryptocurrencies in Canada simple, and it aims to minimize the clutter on its platform.

On Coinbase, you can check out your portfolio of crypto holdings, buy, sell, or convert your cryptos, and you can also easily send and receive cryptos. Like Binance, Coinbase also supports purchasing and selling many coins and allows you to deposit money directly from your bank account into your Coinbase account to facilitate these crypto purchases.

We encourage you to start using Coinbase first if you’re new to investing in cryptocurrency. You can sign up for an account here.

Newton

The fees for trades made on crypto platforms are inconvenient for many new traders. However, if you live in Canada and want to experience a fee-free platform, Newton is the one you should try. Newton’s main selling point is that they don’t charge a fee for trading on their platform.

On top of the savings you get from trading fees, Newton offers a user-friendly experience thanks to its platform’s intuitive design. This simplified user experience ensures that new and experienced crypto traders can easily navigate their user interface without confusion.

Newton issues guarantees with their cryptocurrency in Canada with offline locations without internet connections. This “cold” storage approach helps to prevent any hacks on their exchange.

NDAX

Check out NDAX if you want to buy or sell small concentrations of crypto coins for a small trading fee. NDAX is another Canadian crypto exchange. It allows you to trade 25 of the most popular cryptos today, including Bitcoin and Ethereum.

NDAX is an excellent solution for both new and experienced traders. It offers a straightforward and intuitive trading interface where you can quickly start trading crypto. For experienced traders, you can take advantage of NDAX’s more advanced features.

NDAX is another excellent security choice. If you ever have issues with your account, you can access their customer support 24 hours a day, seven days a week.

BitBuy

The last in the trio of the more popular Canadian crypto exchanges is BitBuy. Established in 2016, BitBuy is another crypto platform that caters to new and experienced traders. Beginner traders can use their BitBuy Express. This “light” version of the platform quickly and easily helps newbies execute their first trade. This first impression will enhance any first-time user’s experience.

If you’re more of a seasoned crypto trader, you might enjoy the BitBuy Pro version of this platform. This robust platform allows for access to live order books. For experienced traders who want to place more significant trades (over $50,000), BitBuy also offers a tailored concierge experience. Concierge customers can place a sizeable over-the-counter trade, leveraging Bitbuy’s services’ expertise.

Cold Storage Devices for Cryptocurrency in Canada

Cold storage devices are essentially an offline wallet that isn’t connected to the internet. This obviously makes it impossible for hackers to hack into your wallet. There are two forms of cold storage. The first is simply a paper wallet on which you would transcribe the public and private keys. The other and more convenient way is by using a hardware wallet. These hardware wallets typically come in a USB device and run flawlessly on a computer with proper USB outlets.

Here are some of the more popular offline, cold storage devices:

Trezor

TREZOR was the first cold storage hardware wallet. It is still one of the leading players in the cold storage device market. It is an excellent place to store your cryptos because of its robust security features. As you would expect, it is an offline device. To access your holdings in your TREZOR, you’ll have to enter a PIN code. You can also back up your TREZOR wallet by using the 24-word seed. TREZOR also recently released a desktop suite to access your coins. This suite also allows you to determine the value of your portfolio in numerous fiat currencies.

TREZOR supports holding the major cryptocurrencies such as Bitcoin, Ethereum, XRP, and Cardano, to name a few. However, they are consistently adding more capabilities about cryptocurrency storage within their wallet.

Ledger

The other dependable cold storage hardware device is Ledger. Ledger is very similar to TREZOR in terms of its security and functionality. But many people tend to find Ledger a bit easier to use and set up.

Ledger has two products available. They are the Ledger Nano S and its more expensive cousin is the Ledger Nano X. Most people should consider just getting the Ledger Nano S as it fulfills the fundamental security and cold storage needs. However, you may want a cold storage device that is more mobile-friendly and supports more than six coins on the device. In this case, you might want to opt for the Ledger Nano X.

Much like TREZOR, Ledger uses an accompanying web app that you’ll have to download. This web app is where you’ll see your crypto holdings and their value. It also requires a PIN code to access the cold storage device and allows for a 24-word backup.

Check out this comparison list on Ledger’s website if you’re interested in learning more about the Nano S and Nano X differences.

Check out NDAX if you want to buy or sell small concentrations of crypto coins for a small trading fee. NDAX is another Canadian crypto exchange. It allows you to trade 25 of the most popular cryptos today, including Bitcoin and Ethereum.

NDAX is an excellent solution for both new and experienced traders. It offers a straightforward and intuitive trading interface where you can quickly start trading crypto. For experienced traders, you can take advantage of NDAX’s more advanced features.

NDAX is another excellent security choice. If you ever have issues with your account, you can access their customer support 24 hours a day, seven days a week.