If you’re reading this article, chances are you have already passed the age of 30. This is an exciting yet stressful period for most people. You have a lot on your plate with your career, your partner, or perhaps a child or two. It is easy to feel somewhat overwhelmed. And, learning to be smart with your money and managing your personal and family finances, don't make it easier.

Don’t worry, this post guides you towards the most important financial aspects you need to take care of. It won’t take much time and it will have a (very) positive impact on your life.

The Bitcoin Standard is a recommended book that we recommend all users to read to get familiar with the concept of Bitcoin.

Top 5 Ways to be Smart with Your Money in Your Thirties

- Understand and manage your money well

- Family budgeting and money

- Get used to investing

- Grow your career

- Take care of your future

- Manage well your money

The foundation of healthy personal finances is a well-balanced budget. It may seem daunting at first, but this is much easier (and, even fun if you like numbers) than it seems.

Create an Emergency Fund

This is an important element of your budgeting. You should build an emergency fund if you haven’t already. Ideally, you should already have some money on the side, just in case. If you already have done it, congrats!

But don’t stop here, it is time to increase it. Your life is changing, your projects get bigger (a family, a house, etc..) and you need more financial security. If you don’t have any emergency savings, hurry up to start one!

Your emergency funds should cover at least 3 to 6 months of essential expenses. From there, you want to reach something around 12 months, especially if you have, or consider having, a family. Even if you have a partner, don’t rely on their savings because you never know.

Take Care of Your Debts

If you haven’t yet paid off your student loan, put more money aside to dig your way out. Increase your monthly payments if you can to accelerate the process. Don’t stay in debt any longer.

It is like a drain where your money flows away from your wallet. You will probably think about taking bigger loans, such as a mortgage, and having these debts won’t help get your application accepted!

Get a Credit Card

If you don’t have one yet, it may be time to get yourself a credit card. This will help you build a positive credit score. You have to choose which credit card suits you best.

One important factor to pay attention to is the grace period. This is the time between your purchase and when you have to start repaying with interests. Some cards offer benefits in travel miles. Others propose cash back, or both.

If your credit score is low, you won’t have access to the best ones. This is okay. With time, you will improve it and become a valuable candidate for more prestigious (and rewarding) cards.

Pay Off Your Credit Card

Credit cards are very convenient and a powerful financial tool. But you have to be careful because they can be dangerous for your budget. It is very easy to spend more than you would with a debit card and you may end up with a bad surprise at the end of the month.

Make a habit to pay off your spending regularly (at least once a month). Check the grace period which depends on your deal and try to pay it off before your reach the end. You won’t have to pay any interest.

In any case, don’t be late for your payments, this won’t be good for your credit score.

Build or Maintain a Good Credit Score

If you follow the advice below for your credit card, you’ll build a good credit score over time. The same goes for any loan you have. Being smart with your money doesn't mean just your money. It means your credit too!

Make sure you pay always on time. You can use direct debits to never be late without worrying about the payment dates.

You don’t want to have too many loans either. This would send a signal that you don’t manage your budget very well and that you need to borrow money regularly.

In the end, it is not complicated. Nothing to stress about as you see!

If you don’t know what your credit score is, you can check it by signing up for a free member's account on our site. Have a check every year or 6 months to see how you are doing.

Keep Some Money to Have Fun

Life is not all about savings and interest rates, you get to live your life! Even with a modest budget, you can still have fun. Don’t feel guilty about spending for frivolities.

As far as you keep control of your budget, it is totally fine to spend a part of it freely. Living a good life is like managing a budget. It is a question of balance!

Family Budgeting and Money

Talking about life, at age 30 or more, you may share it with someone. Or multiple ones!

Your budget is then more than your own personal finances. It is time to think larger and take care of having healthy family (or couple) finances. Being smart with your money means creating budgets, and sticking to them.

Be Smart with your Money with your Partner

Sure, it is not the most romantic conversation topic. It is important though when you share your life (and your money) with someone else to talk finances.

You may have different habits or opinions about how to manage a budget. As for other topics within a couple, communication is key.

Find a common ground or an arrangement between you if you don’t agree initially.

Maybe one of you will be in charge of the whole budget. Or you will have a budget meeting together each month to review your spending and define your financial goals for the next month.

Your couple, your rules! Just be sure to have this kind of conversation, without finishing obsessed and stressed out about it.

Saving for Your Wedding

If you have found your soul mate, you may consider getting married. This is not an article about how to organize your wedding, but you have to know that it is often a big expense. Be prepared.

The average cost of a wedding in Canada is about $29450. Yep, that is a lot of money. It doesn’t mean that you have to spend that much (or that little depending on your situation!).

However, it is sensible to start saving for your magical day now, even if you are not engaged yet.

Talking about engagement, this can also be quite expensive depending on how you want to do it (if you are the one proposing!).

Saving to Have Children

A natural consequence of a wedding is these little creatures crying and running all around you. Okay, okay. They are also laughing and smiling a lot and it is wonderful to have kids!

But they represent a whole new bucket of expenses in your budget. It is safer to have a starting sum to deal with the organization of your home or even move to a bigger place.

You will discover that having a baby can cost about $9000 in the first year. Buying diapers, all the gear (yes, all those things you didn’t know about before!), the feeding. All these things add up.

You can of course be smart and borrow from friends or buy second-hand things. But still, better safe than sorry!

Saving for Your Children's Education

There is something children are really good at growing up. And fast! This means that sooner than later, you’ll have to think about their education. And the cost of it!

Even if you can’t or don’t want to cover all the college fees, you can still help.

A smart way to do it is to deposit money in a Registered Education Savings Plan (RESP). It will also help apply to education grants down the road.

Get Used to Investing

When you have a minimum of emergency savings (at least a few months’ worths of regular expenses), you should consider investing.

This doesn’t mean putting all your money in the latest crypto-currency without pondering the risks.

Educate yourself in different investments options, such as stocks, real estate, mutual funds, etc… The list goes on and on.

Be Careful With your Asset Allocation

Diversifying is key here to avoid too many risks with your finances.

It might be a good moment in your life to hire a financial advisor who will help you make sensible decisions.

Your banker can probably help you as well. But take the time to talk to different banks since they will all want to sell their own financial products.

Open a TFSA

A what? A Tax-Free Saving Account.

This is an interesting and safe investment. The annual contribution is caped to around $6000 but with years it will build up. A TFSA is a positive step to being smart with your money because it's exactly that: Tax-free!

Grow your Career

You are at an age where your career should be at its full speed. If you are stalling, it might be a good time to review your situation and your goals.

Don’t make irrational decisions, but a reality check can help you take a better road if need be. One of the best ways to help your career growth is to continue to educate yourself or enroll in training offered by your company or third-party organizations.

This seems to be the “secret” of all wealthy people: reading books, educating themselves, continuously.

It can be on your present skills to become more competent (hence valuable). But it can also be to develop new ones that complement yours and make you stand out compared to your competition.

This is a strategy that complements being smart with your money. And it will go a long way to reach your financial (and life) objectives.

Take Care of your Future

Your present actions define your future. Besides its philosophical value, it is actually a very practical statement.

Making decisions now about your personal finances will change your situation in the coming years and even for the rest of your life.

Set a Retirement Target Date and Amount

It seems far away and it is!

But the day will come when you will cease your professional activity and your income will fall down.

Since you want to enjoy life for many long years after you retire, it' strongly advised you set a date now and an amount you would like to have.

The investment relies on compound interest, so the later you start the less money you will have.

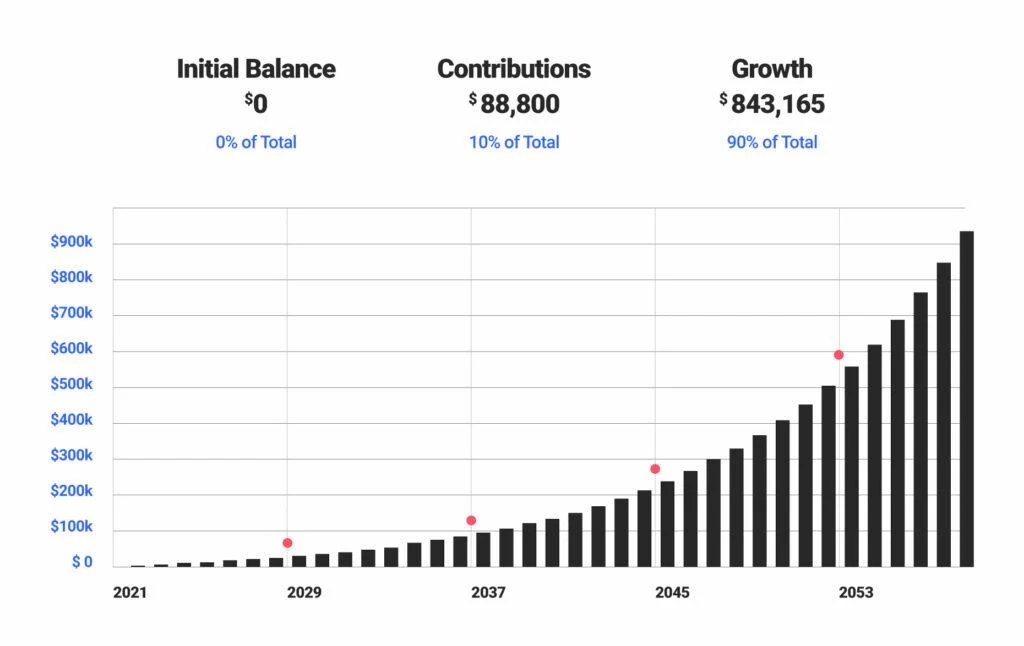

Have a look at this simulation for example:

This is what you will get by setting aside $200 each month, starting at 30. That’s a nice amount to have to live your retirement!

However, it goes down to only $164,569 if you start at 40! Not great.

Life Insurance is Being Smart with your Money

This is not only for old people, quite the opposite. The contributions are lower at age 30. Actually, it is about half the contribution you would pay at 60 years old.

It will add some financial security to your family in case something happens to you (let’s hope not, but who knows). You don’t want to leave them with debts.

Make a Will

To continue with the same mood, let’s talk about your will.

I know. It is not something you want to think about now. You are just starting your adult life and you are full of life and projects. But hey, death is part of life. Nothing to be afraid of, but rather something you should be prepared to.

Like having life insurance, making a will is a way to protect your family and avoid confusion (and conflicts!) around your assets and savings.

Conclusion

Being smart with your money doesn’t require being an expert in finances, but rather taking sensible decisions.

You have to be in control of the situation instead of being controlled by your money.

The best thing to do is to educate yourself continuously. It is like other skills. You will get better with time if you make a little effort regularly.

That’s what you have done today so congratulations for taking responsibility for your personal finances!