The years 2020 through 2022 will be remembered for the disruption caused by the global pandemic and the emergence of retail investors. Due to remote work and some government stimulus, people having more time on their hands also drove the soaring prices of meme stocks, Non-fungible Tokens (NFTs), and cryptocurrencies. But then, it all came crashing down. So we are now returning to the idea of responsible investing in Canada.

As more retail investors have entered the market, it has become clear that many lack the knowledge and understanding to make sound investment decisions.

This article will help you:

- Define responsible investing.

- Make better investment decisions by identifying and avoiding “FOMO.”

- Determine how much you can invest and when.

- Understand compound interest and how it can help you grow your money for large purchases and retirement.

- Identify various tax-free and retirement savings accounts in Canada (and even one in the United States).

Investing Responsibly in Canada

Do not trade on emotion. Period. Until you understand and feel comfortable with market volatility, the only trades you make should be done using a practice account.

Creditpicks

Tweet

When inexperienced investors first put money in the market, they may be unaware of how to invest responsibly. They may be influenced by the Fear of Missing Out (FOMO) on potential quick profits. Unfortunately, this often leads to little consideration of the risks and rash decisions.

Inexperienced investors may be tempted to invest more than they can afford. They may even take out loans to fund their investments. This is not recommended, as it is one of the most irresponsible things you can do when investing.

Making Good Investment Decisions

When considering investing, it is vital to approach it responsibly. So, if you don't read any further, the following four takeaways are what we want you to remember. These points are crucial to making better investment decisions (or at least preventing a catastrophe).

- It is important to remember only to use what you can afford to invest. For example, if you have been budgeting $3,000 a month for your basic needs, such as rent, food, and utilities, do not dip into these funds to make investments. Instead, you need a roof over your head and food on the table.

- If you're new to investing, you should initially take on long-term positions. It is easy to get carried away by the excitement of a sudden surge in penny stock or cryptocurrency prices. But you must remember that these prices fall just as quickly. The meme stock, NFT, and cryptocurrency markets are a roller coaster ride of highs and lows. Long-term investment strategies are a better starting point because you can use them as hedges for riskier positions. And when taking on riskier positions, you should do so only with what you can afford to lose immediately.

- Taking on debt to finance investments is not advisable. The appreciation of market investments can be unpredictable, and the loan's interest can be a burden. Moreover, if you lose on your investments, you could end up paying down the loan for a long time. The only exception to this rule is fixed or tangible assets such as real estate. But even the housing market is experiencing high volatility currently.

- Avoid leverage. In simplest terms, leverage is the same: money borrowed for trading. However, many brokerages allow you to trade with leverage using margin accounts.

How Much Should I Invest?

The amount you should invest in currency, cryptocurrency, and stock markets is subjective and can vary depending on lifestyle and income. For example, what is suitable for someone who earns a substantial salary and lives in an inexpensive area probably is not the same as someone who makes a lower salary but lives in an expensive city centre.

For those looking to invest long-term, use the 50/30/20 Rule. Or a more reasonable percentage of your income might be 10-15%. This is just a guideline. Your circumstances should be considered when making this decision. Don't be afraid to allocate a smaller portion of your salary if other areas of life require more attention.

How you invest also depends on your situation. For example, some prefer to invest a single, large amount each year due to a lack of time or interest in managing investments. Others who actively manage their portfolios choose to invest smaller amounts more frequently. When deciding how much to invest, ensure it is feasible and aligns with your overall investment strategy.

When Should I Invest?

Committing to becoming a responsible investor is a great decision, but the question remains: when should you start? The universal answer is: the sooner, the better. Establishing a portfolio of investments earlier in life will put you in a much better place when you retire. There are many benefits to investing sooner rather than later.

The Benefit of Time

Starting to invest early, like in your 20s, allows you to bounce back quickly if you make a riskier choice. It is typical for young investors to take chances in pursuing success, but this approach may not pay off in the end and could be detrimental to your financial health. Taking risks must be balanced out with safer investments when investing, and although younger people may be able to take more risks, this should be counteracted with more secure investments. This approach is called hedging.

Older investors should know they may have less time to recover losses if they invest in riskier options. Therefore, they should start investing sooner rather than later and find a balance between safer and riskier investments.

Compounding Returns

Investing early allows you to use compounding when your earnings are reinvested into your investments, resulting in growth over time.

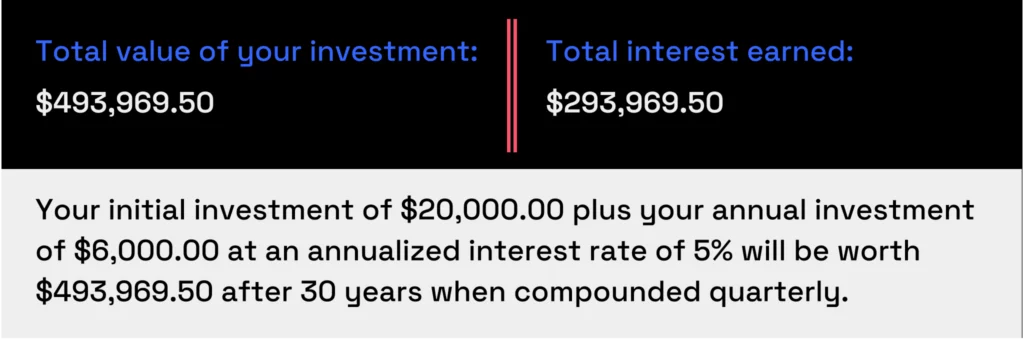

Reinvesting the dividends you receive from a dividend stock can be an effective way to increase the value of your investment. An example is if you start by putting a $20,000.00 principal investment into a $20.00 stock that yields a 5% dividend every quarter. After 30 years, your initial investment of $20,000.00 would have grown to $88,804.26!

This can be a great way to increase your returns over the long term.

What if we wanted to grow our investment in this stock by adding constant money annually?

We could invest an extra $6,000.00 per year for 30 years. If all other factors remained the same, our original $20,000.00 investment would grow to almost $500,000.00 after 30 years!

If we kept adding an extra $6,000.00 yearly, we could increase our total investment by $405,165.24.

This shows that making your money work for you can be beneficial. If you can invest in something that will generate returns without touching your initial investment, reinvesting those earnings will help your investment grow.

The key to success with this plan is to keep adding money to the investment regularly. This will help the money grow over time, which is especially beneficial when you need it during retirement.

Tax-Free Accounts in Canada

Ultimately, death and taxes are the only certainties in life. As such, it is crucial to explore ways to reduce the amount of taxes paid legally. Fortunately, tax-free savings accounts help investors grow their money without incurring tax payments or postponing them.

It is imperative to make the most out of tax-free savings accounts. Although the financial benefit may not be apparent right now, the cumulative effect of these savings can make a significant difference in the long run. Here are some accounts that can help you grow your investments without incurring taxes.

Tax-Free Savings Account (TFSA)

In Canada, adults can use a Tax-Free Savings Account (TFSA) to invest in the markets. The government allows up to $6,500.00 in contributions to this account in 2023, and a key advantage of using this type of account is that it is exempt from capital gains taxes. In addition, any profits from selling stocks in a TFSA will not be taxed.

The TFSA is an ideal savings account since it allows you to access any saved funds without worrying about incurring taxes. By making regular contributions to this account, you can quickly accumulate a substantial amount of savings you won't have to pay taxes on. A TFSA's tax savings is easy money.

Registered Retirement Savings Plan (RRSP)

The Registered Retirement Savings Plan (RRSP) is an excellent choice for Canadians who want a widely-used investment account. Unlike a Tax-Free Savings Account, you must pay taxes when you take money out of your RRSP at retirement. However, since you won't be earning an income after retirement, the taxes you owe won't be as high.

The contribution limits for RRSP are also different from the TFSA in that you can contribute up to 18% of your reported income on your tax returns, but with a contribution cap set at $30,780.00. An RRSP is a safe investment for retirement.

Roth IRA (United States, Only)

The Roth IRA is a retirement saving account in the United States similar to a Tax-Free Savings Account (TFSA) in Canada. Contributions to a Roth IRA are taxed initially but gain tax-exempt status when you withdraw funds.

The Roth IRA offers a tax advantage as your contributions are taxed lower than usual. As a result, when you withdraw the funds in retirement, there is no tax due on the accumulated amount. In addition, there is an annual contribution limit, which in 2023 was $6,500.00, but those over 50 can contribute up to $7,500.00.

Responsible Investing Means a Secure Future

Getting caught up in the hype of high-risk speculative investments like stocks and cryptos may be tempting. But it's important to remember that these investments are unpredictable and could devalue to nothing near-instantly. Investing responsibly may seem unexciting, but with some patience, it will pay off by way of a secure future. And, who knows, maybe some of your less risky investments will become your biggest earners.