When assessing online life insurance in Canada in today’s fast-paced world, efficiency and convenience are essential. PolicyMe, a leader in Canadian online life insurance, is at the forefront of this transformation. PolicyMe offers a user-friendly, streamlined experience that leverages technology to improve the insurance application process. The application process can be completed online and you can receive a quote within minutes.

This overview explores the innovative features of PolicyMe as an online life insurance provider in Canada, available nationwide across all Canadian provinces and territories.

What is PolicyMe?

Founded in 2018, PolicyMe is an innovative online insurance provider specializing in simplifying the insurance process. Term life, critical illness, dental and health insurance are the coverages offered by PolicyMe. This overview will focus mainly on life insurance as they are best known for this. The platform is designed specifically to reduce the complexity and inconvenience typically associated with traditional insurance applications, making it an excellent choice for individuals and families seeking straightforward, no-hassle financial protection.

What is life insurance?

In Canada, life insurance comes in two primary types: term life insurance and permanent life insurance.

Term life insurance provides coverage for a specific period of “term”, such as 10 years, up to 30 years. Permanent life insurance (T100) on the other hand, provides lifelong coverage.

Core features and benefits

- Efficient Online Process: The entire application can be completed online in a matter of minutes, eliminating the need for face-to-face meetings and physical paperwork.

- Cost-Effective Solutions: PolicyMe offers some of the most competitive pricing on the market by minimizing overhead costs and passing these savings on to the customer

- Clear and Concise Policies: Every policy is written in plain language, ensuring that users can easily understand their coverage without the jargon typical of traditional insurance contracts.

How PolicyMe streamlines the application process

PolicyMe's approach to insurance is designed with convenience in mind.

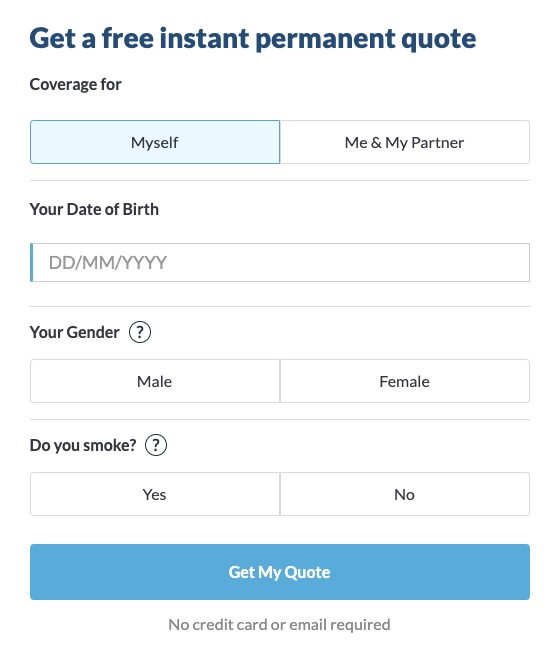

- Receive estimates instantly: You start by filling out a brief online form about yourself including your age, province, if you smoke and gender. It only takes 30 seconds to get your online estimate.

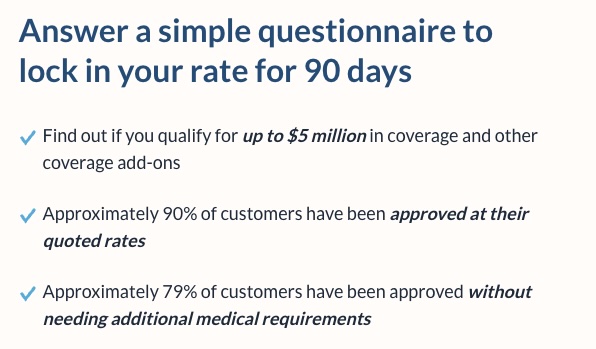

- Application Submission: Fill out information detailing your lifestyle and health, which takes about 20 minutes.

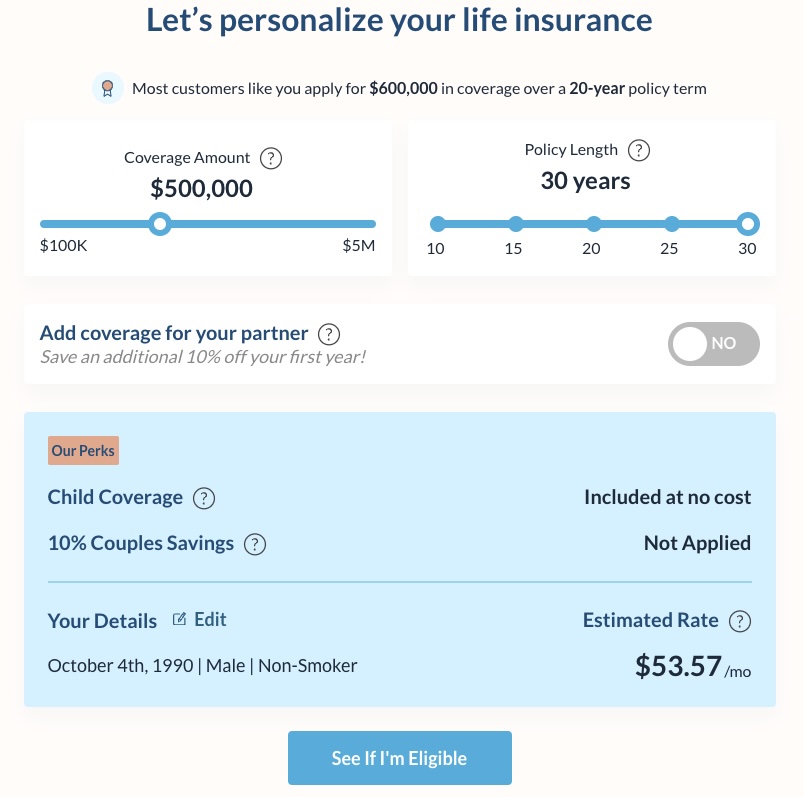

- Customize coverage tailored to your specific needs: You can choose various coverage options to best tailor to your own specific situation. For example, you can customize the coverage amount and policy length for life insurance. The estimates will change based on what is being customized.

- Undergo medical reviews if necessary: If necessary, PolicyMe coordinates a medical exam to finalize coverage details.

- Coverage activation: If you are happy to proceed, then upon final approval your new insurance coverage starts. All policy documents are digitally accessible.

Learn more or start the application process here.

User experience features

The website is mobile-friendly and designed to provide a smooth and integrated experience. You can easily access all your policy information on the online portal.

Coverage

Coverage is flexible based on your specific needs.

- Coverage amount: $100,000 to $5,000,000 for term life insurance

- Term length: 10, 15, 20, 25, 30 years. Permanent life insurance (T100) is also offered

- Age: 18 to 75

Pricing

PolicyMe's transparent and straightforward pricing model sets it apart in the financial services sector. Term insurance is convertible and renewable. Convertible means you can convert from a term life insurance to a permanent life insurance.

There are absolutely no hidden fees, ensuring transparency and trust. Premiums are calculated based on individual risk factors and chosen coverage levels, providing personalized price points.

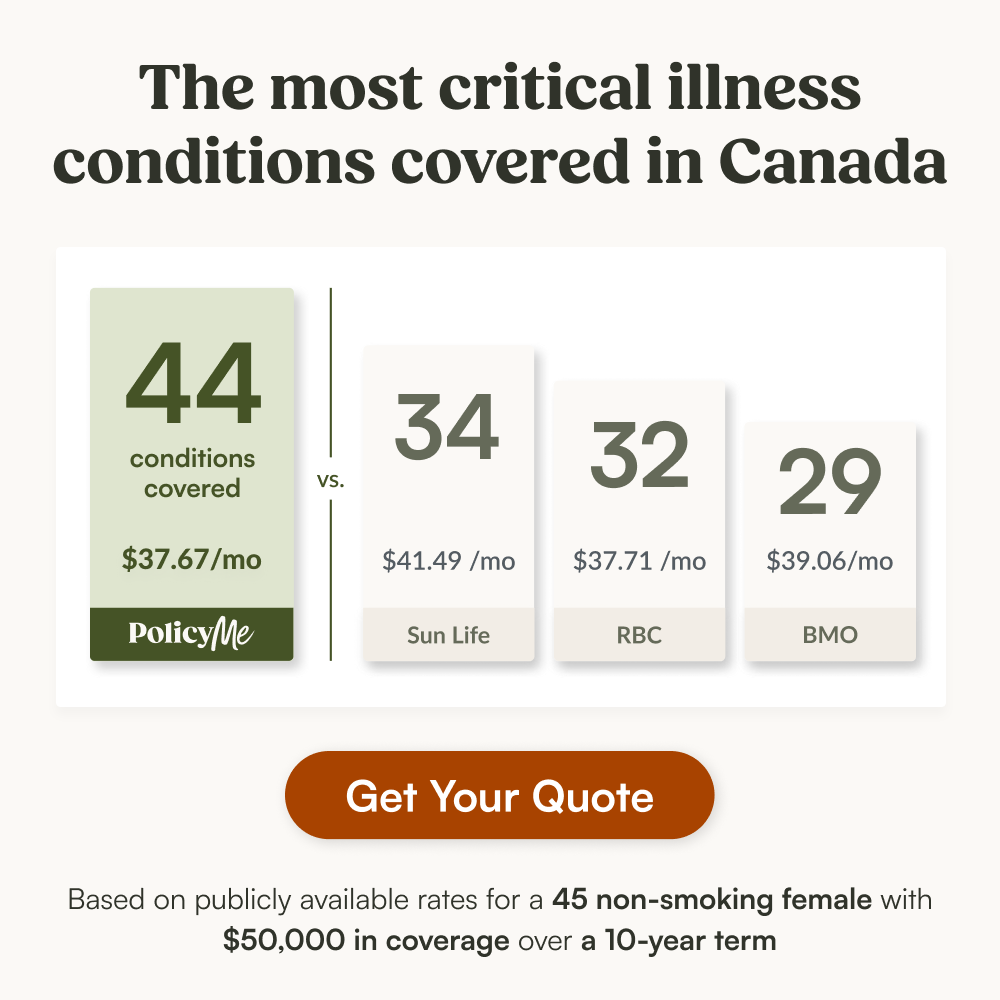

Here is a pricing comparison table

| Feature | PolicyMe | Traditional Life Insurance |

| Application | 100% online | May require in-person interviews |

| Premium | Generally lower due to reduced administrative and overhead costs | Generally higher due to higher administrative and overhead costs |

| Customization | Flexible. Coverage amount for term life insurance from $100,000 to $5,000,000 | Flexible |

| User experience | Digital and streamlined | It can be time-consuming and require more back and forth |

Other perks

- Joint Application: There is also the opportunity to apply with a partner with a joint application. There is 10% off for couples in the first year of term insurance policies

- Child Coverage: Life insurance policy includes $10,000 for child coverage

Safety and security at PolicyMe

With digital services, security is always a concern. PolicyMe addresses these concerns head-on with rigorous security measures designed to protect personal and financial data. All personal data is encrypted using advanced protocols to prevent unauthorized access. Additionally, PolicyMe strictly adheres to Canadian privacy laws and regulatory requirements, ensuring your data is handled responsibly.

Application Process

Life Insurance

To get started, get a free instant quote here.

You can customize your coverage amount and policy term length based on your specific needs. An estimated rate will be provided. Click on eligibility to continue the application process.

Health and Dental

PolicyMe also launched health and dental insurance coverage in 2024.

What is Health and Dental Insurance

Health and dental insurance is a type of insurance coverage that provides financial protection for various out-of-pocket medical, vision and dental expenses. These policies typically offer coverage for a range of healthcare services and treatments that are not fully covered by government health plans in Canada.

Key Components of Health and Dental Insurance in Canada

- Prescription

- Extended Health Benefits

- Dental Care

- Vision

- Telehealth Services

- Hospital Accommodation Benefit

No medical questions will be asked; coverage is guaranteed!

For more detailed information and to get a free instant quote here.

Conclusion

If you’re looking for a way to protect your family from unexpected events, PolicyMe is an excellent, affordable option for online insurance. You can explore your options by completing PolicyMe’s application and getting a quote in minutes!