Creating a budget is a proactive step toward financial empowerment. By learning to make a budget, you're not just planning how to spend your money—you're crafting a strategy to build your desired life. A budget creates a practical roadmap to define and achieve financial well-being, which should be everyone’s goal.

A budget is more than just a dull, no-fun tool

A well-thought-out budget is your design for achieving prosperity.

Creditpicks

Tweet

A budget is more than a financial tool—a personalized plan that reflects your income, expenses, and financial aspirations. It demonstrates your commitment to financial discipline, enabling you to make informed decisions about your spending and savings. Here's how to view a budget:

- Blueprint for prosperity: A well-thought-out budget is your design for achieving prosperity. It's about making intentional choices with your money.

- Visibility and control: You gain visibility into where your money goes and take control of your financial future.

- A means to an end: Whether buying a home, funding education, or preparing for retirement, a budget aligns your finances with your life's goals.

Why budgeting is non-negotiable

Budgeting is indispensable, and here’s why:

- Prevents overspending: It keeps your spending in check, ensuring you live within your means.

- Debt management: Aids in steering clear of debt or helps to pay it down methodically.

- Savings amplifier: It's a mechanism to amplify your savings and investment efforts systematically.

- Advertisements

The very basics of budgeting

Information is power. And budgeting is easy. It is that simple. The Financial Consumer Agency of Canada (FCAC) makes it even easier with this new interactive Budget Planner.

However, every budget works from the same three basic principles:

| Step | Action | Output |

| 1 | Assess your income | Note down all income sources post-tax, from your regular paycheck to any side hustles |

| 2 | Categorize expenses | Distinguish between fixed costs (like rent and car payments) and variable expenses (such as dining out) |

| 3 | Set goals | Define clear, achievable financial goals, from building an emergency fund to planning for a vacation. |

Mathematically, here is the equation for your budget:

Money coming in — money going out = money for goals, fun, and more

Ready to start your budget? You can start today by visiting FCAC’s Budget Planner page.

Budgeting best practices

Budgeting is both a science and an art. Here are some practices to guide you:

- Be realistic: Set attainable goals that match your lifestyle and income.

- Stay flexible: Life is unpredictable. Adjust your budget as needed to accommodate changes.

- Monitor regularly: Regular reviews keep you on track and allow you to spot and fix issues swiftly.

Designing your monthly budget: A step-by-step guide

A monthly budget is a dynamic document that evolves with your financial situation. Here's how to get started.

Step 1: Gather financial data

- Income statements: Pay stubs, bank statements, and other proof of income.

- Expense receipts: Bills, credit card statements, and receipts to account for every dollar spent.

| Sources of income | Amount | Frequency |

| Job salary | $X | Monthly |

| Freelance work | $X | As-earned |

Step 2: Define your spending habits and goals

- Fixed expenses: Mortgage/rent, utilities, loan payments—expenses that don't change month-to-month.

- Variable expenses: Groceries, leisure, unplanned purchases—expenses that can vary.

Step 3: Adopt a budgeting framework

- The 50/30/20 rule: A popular method for balancing needs, wants, and savings.

- Zero-based budgeting: Every dollar is allocated to a job, ensuring no wasted money.

Step 4: Set up your budgeting toolkit

Consider Canadian-friendly digital tools to streamline your budgeting:

- Pocket Smith: Customizable and comprehensive.

- YNAB: A proactive budgeting app to give every dollar a purpose.

Step 5: Implement, track, and adjust

- Review cycle: Set a regular schedule to review your budget.

- Adjustments: Be proactive in adjusting your budget to reflect actual spending.

Step 6: Protect and grow your wealth

- Emergency fund: Aim to save at least three to six months of living expenses.

- Investment: Explore options like high-yield savings accounts and retirement funds.

Advertisements

Mastering debt management within your budget

When you make a budget, addressing existing debt is crucial. Debt can be a significant barrier to financial freedom, but you can manage and eventually eliminate it with a strategic approach. Here's a structured way to tackle debt.

Prioritize high-interest debts

Credit cards often carry high-interest rates that can balloon over time. Prioritize these debts to minimize interest payments. A simple table can help visualize your plan:

| Debt type | Interest rate | Monthly payment | Remaining balance |

| Credit card | 19.99% APR | $150 | $2,500 |

| Student loan | 5.5% APR | $250 | $10,000 |

| Car loan | 3.99% APR | $300 | $15,000 |

Balance payments and savings

While paying off debt, it's also essential to save. Even if it's small, regularly contributing to a savings account can provide a cushion for unforeseen expenses.

Preparing for the unexpected

Life is full of surprises, and some can have a financial impact. Your budget should include a strategy for such unexpected expenses. This is where your emergency fund comes into play.

Start by setting aside a small portion of your monthly income until you build a substantial safety net. Experts suggest an emergency fund covering at least three to six months' living expenses. If you're starting from scratch, here's a simple goal-setting bullet list:

- Short-term goal: Save $1,000 as a starter emergency fund.

- Mid-term goal: Accumulate three months' worth of basic living expenses.

- Long-term goal: Build up to six months or more of living expenses for comprehensive financial security.

Navigating budgeting tools and resources

With various digital budgeting tools available, selecting the right one can be daunting. Look for features that resonate with your budgeting style and financial goals. Here's what to consider:

- User experience: The app should be intuitive and easy to navigate.

- Security: Strong security measures are essential to protect your financial data.

- Connectivity: The ability to link to your Canadian bank accounts and credit cards for real-time tracking.

- Support: Robust customer support to assist you when needed.

Some notable apps that meet these criteria include:

- YNAB (You Need A Budget): Known for its proactive approach to budgeting.

- PocketGuard: Simplifies budget management by showing how much disposable income you have after scheduled payments.

Advertisements

Budgeting for a $2,500 monthly income

To put budgeting into perspective, let's consider a scenario where your monthly take-home pay is $2,500. How do you budget this effectively? Here's a step-by-step guide:

- Calculate net income: Ensure you're budgeting your after-tax income (in this case, $2,500).

- Categorize and allocate funds: Using the 50/30/20 rule as a guideline, divide your expenses into needs, wants, and savings/debt repayment.

- Plan for irregular expenses: Set aside funds for costs that don't occur monthly, like property taxes or annual insurance premiums.

- Adjust as necessary: If your expenses exceed your income, look for areas to cut back, such as dining out or subscription services. In table form, this is the breakdown:

| Budget category | Allocation |

| Needs (50%) | $1,250 |

| Wants (30%) | $750 |

| Savings (20%) | $500 |

By following these steps, you can create a balanced and sustainable budget on a $2,500 monthly income, ensuring you live within your means while saving for the future.

Remember: Creditpicks is your partner in navigating personal finance. Whether crafting a new budget or refining an existing one, turn on our browser notifications for insights and tools to support your journey.

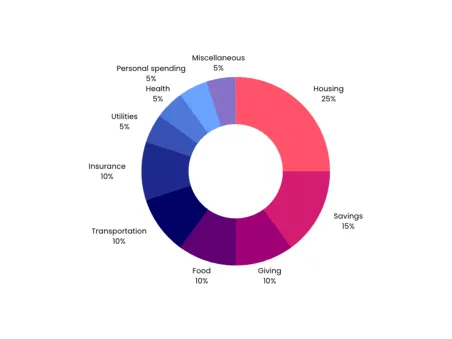

Understanding the 50/20/30 budget rule

It is actually the “50/30/20 rule” (makes sense, right?). But whatever you call it, the 50/20/30 budget rule is a simple yet effective framework for allocating your income to different expenses. Here's how it breaks down:

- 50% on needs: These are your essentials, such as housing, groceries, utilities, and transportation.

- 20% on savings and debt repayment: This includes contributions to your emergency fund, investments, and debt obligations.

- 30% on wants: This is for your personal, discretionary expenses like dining out, hobbies, and entertainment.

There is no “one size fits all” in budgeting. This adaptable rule allows you to modify the percentages to better fit your financial situation and goals.

The imperative of budgeting

Budgeting is not just about restriction; it's a strategic tool for freedom and choice. First, it empowers decision-making. With a budget, you make informed choices about your spending rather than decisions based on impulses.

It also enables goal achievement. Whether it's a vacation, a new home, or retirement, a budget helps you save for and achieve these goals. Finally, it provides financial control by allowing you to anticipate cash flow, control debt, and manage your financial future.

After a budget, the possibilities are endless

By taking the time to make a budget, you're setting yourself up for success and peace of mind. Whether you want to buy a house, go to school, or travel the world, a budget sets the groundwork for you to save for any of these goals while ensuring a solid financial foundation for the future.

If you're ready to take the next step towards financial stability and prosperity, Creditpicks is here to support you. With resources, tools, and advice tailored to the Canadian financial environment, we’re dedicated to helping you achieve your financial dreams.

Take control of your finances today—enable browser notifications, and let's make this journey to financial empowerment together.

Advertisements