As a parent, you always want the best things for your kids in Canada. However, the best things in life are not just the most recent or popular toys, clothes, or gadgets. You need them to be safe and secure throughout their entire life. That is why teaching them the basics of financial responsibility is critical, as it guarantees their well-being in the future.

Research indicates that children taught the value of financial responsibility from a young age tend to make better financial decisions as adults. Therefore, you need to have regular conversations with your kids to prepare them for game-changing financial choices in the future. A correct teaching approach can lay the foundations for your kid’s future success.

Why Financial Responsibility is Important for Kids in Canada

Kids in Canada need to know how to manage money and be responsible for financial matters. It has several benefits for parents and their kids’ future, enabling them to become financially independent as adults, save for their future, and more.

The High Cost of Living in Canada

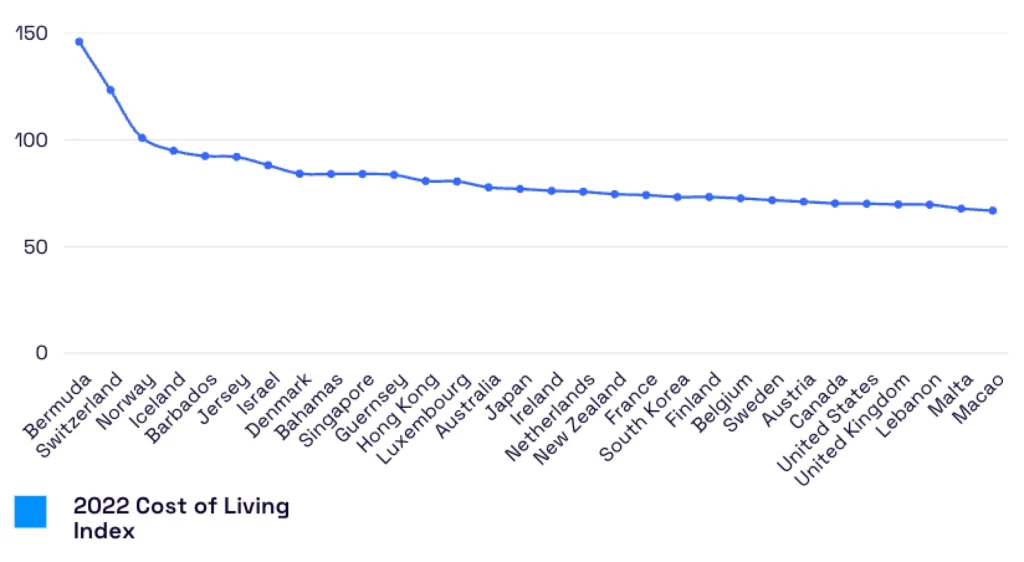

Canada is one of the most expensive countries in the world. Canada holds the 25th position among the countries with the highest cost of living worldwide, according to Numbeo’s 2022 Cost of Living Index. This ranking becomes more significant when you remember there are nearly 200 countries worldwide. With Canada’s 30th position in the 2021 rankings, the country is climbing the list quickly.

Factors such as the pandemic, supply-chain issues, and inflation have recently contributed noticeably to Canada’s high cost of living. The problem is even more considerable in major cities such as Vancouver, which ranks among the most expensive cities in the world to live in. However, even for this reason, teaching financial responsibility to your kids in Canada is worth it.

The Importance of Financial Independence

Financial independence is one of the most important life goals people strive to achieve. Your children in Canada must learn the basics of financial responsibility from childhood to become financially independent as adults.

Achieving financial autonomy gives adults the power to shape their destiny, experience greater tranquillity, and have the opportunity to do what they desire, including taking part in activities they love and having quality time with their family and friends. It also allows them to minimize their workload and dedicate more time to leisure.

The Value of Saving for the Future

Having the ability to save money is essential for long-term stability and success.

You already know how worthwhile saving money for the future is. Saving is crucial for everyone, regardless of their earnings, spending habits, and life stage. Kids in Canada are no exception. And there are ways for you to help them learn how to save for their future while enjoying doing it.

Having the ability to save money is essential for long-term stability and success. It can provide children and their future families with better educational opportunities, help with short-term objectives, and provide security in an emergency. In addition, teaching children the importance of saving money early on will help them plan for their future and ensure they are better prepared for any financial issues.

How to Talk to Your Children About Financial Responsibility

No matter what age your children are, educating them on money management and instilling economic confidence is always beneficial. However, it can be challenging to communicate the importance of financial responsibility to a young person. You should demonstrate how you manage college debt and other bills and introduce them to financial terms and concepts that may be unfamiliar to them.

Make it Age-Appropriate

The foundation of money habits is formed very early in kids, when they are as young as seven. But it would be best if you did not focus mainly on age and instead start somewhere. The key point is that you talk to your kids, considering their age, so they understand what you are discussing.

Modern kids are often mesmerized by the convenience of credit and debit cards, believing they are magic. Instead, parents should attempt to explain financial concepts to their children in a way that is easy to understand. Using simpler and more familiar terms such as “saving,” “sharing,” and “choosing” can be an excellent way to introduce these concepts.

Model Good Financial Behavior

Practice what you preach. Your kids need to see you budgeting and making wise financial decisions. Educating your kids about money while avoiding hypocritical behaviours sets a model for them to follow and replicate.

If you frequently express dissatisfaction with how much you are spending and then go on to spend a lot on items you don’t need, your children will be confused. So instead, show them the correct financial behaviours you would like them to learn.

Set Clear Expectations and Boundaries

Establish clear and detailed financial goals for your children. An allowance can be a good way to start teaching them smart money management skills. You can give them money intermittently, such as weekly, biweekly, or monthly, so that they can learn how to budget and plan their spending. Establishing a schedule for the allowance will help them better understand how to handle money.

If you want your children to become financially literate, encourage them to save for a more expensive item they want rather than buy small treats. This will help them learn the basics of budgeting and money management early on.

Ideas for Teaching Financial Responsibility to Children

Teaching children the fundamentals of being financially responsible is integral to parenting in Canada. However, kids are not expected to understand money management, so parents must provide guidance automatically. Here are some tips to help you get started.

Allowances and Budgeting

Your children need to develop an understanding of money, such as budgeting and allowance. To accomplish this, give them regular pocket money to gain real-world experience with financial concepts and build a solid foundation for their financial abilities. This money can be earned through everyday tasks around your home if appropriate.

It is crucial to give young people a chance to take control of their finances and make sound money decisions, so they are ready for financial independence. Furthermore, offering them the opportunity to practice their money management skills helps to boost their self-assurance when it comes to handling their finances, so they will already have experience when they are in charge of their own money.

Opening a Saving Account

It may be time to take your children’s financial education to the next step by providing them with a bank account. Doing this will help them learn how to handle money more effectively and be ready to manage larger accounts.

Encouraging children to save money can be a fun and rewarding experience. Taking them to the bank to open a savings account with the money they have received is a great way to teach them the value of saving and setting them up for financial success. You can also lead by example by depositing an equal amount of money into your savings account as an example of your commitment to saving.

The Value of Work and Earning Money

Children need to understand working and earning money to buy things. They need to be taught about the importance of having a job, as often all they see is their parents leaving the house and returning later. They must understand that their parents are working to provide for their lives.

Therefore, you should make sure to explain to them the importance of having a job. Showing them around your place of employment could be beneficial. They should understand what you do to get money so that you can purchase the things they need, such as food, clothing, and toys.

Smart Shopping and Avoiding Impulse Purchases

Children should be taught how to manage their money effectively. They need to understand the benefits of making wise decisions rather than simply punishing them for bad ones. Purchasing a video game or indulging in candy may be temptations. Still, it is essential for them to think about the repercussions of spending all their money on treats and to avoid criticism from adults.

It is best to teach children to avoid making impulsive buys. When using someone else’s funds, they may want to purchase an item they have just seen without much thought. To aid them in making wiser choices, encourage them to wait at least 24 hours before purchasing.

Conclusion

Raising kids in Canada to be financially responsible is highly beneficial. It allows them to comprehend the cost of living, gain independence, save money, make intelligent decisions, and understand the value of work – among numerous other advantages.

To effectively teach your children in Canada how to manage money wisely, it is imperative to continuously talk to them about finances in a manner that is appropriate for their age. Doing so will enable them to develop a solid understanding of personal finance, which will benefit them long term.