Are you ready to start your credit repair journey today? If so, we’ve teamed up with Consolidated Credit Canada to help you plan and manage your debt. Complete the service request form. Alternatively, you can call our dedicated team at 844-200-7936. Our hours are Monday-Thursday, 8:30 am-8:00 pm; Friday, 8:30 am-6:00 pm; and Saturday, 9:00 am-2:00 pm.

Maintaining a sound credit score is integral to a stable life and household in modern-day Canada. In addition, a strong credit score allows you to access consumer credit products such as car loans, mortgages, credit cards, or a line of credit. Therefore, treating your credit as you would your health is paramount – with a proactive approach focusing on maintenance and intervention before credit repair is necessary.

Why Good Credit is Important in Canada

It is impossible to list all the reasons why you need good credit. And many of the reasons may surprise you because they are not directly connected to obtaining new credit.

You may require acceptable credit to hold a job with a security clearance

You might need good credit to open a stock trading account

Credit checks are standard when you rent a condo, house, or apartment

You probably won’t have to pay deposits for mobile telephone accounts, or other utilities

You may get a discount on your car insurance bill

You’ll likely have more negotiating power concerning your current credit products

A strong credit score is also essential to start your own business. Whether securing a corporate credit or charge card, opening a payroll account, or leasing company cars or trucks, properly managing your credit helps drive your success.

Don’t let your credit suffer at any stage of your life. You never know when you’re going to need it.

Understanding Your Credit Report and Score

Did you know that 56% of Canadians haven’t checked their credit score? And only 14% check their credit report on an annual basis?

In Canada, two main credit bureaus compile, store, and track information about your credit use. These two institutions are Equifax® and TransUnion®. They work directly with creditors (e.g., financial institutions and private lenders) to collect detailed information about your credit capacity, utilization, and history. These credit reporting agencies assign you a three-digit credit score between 300 and 900. The higher your score, the better it is.

As a best practice, you should check your credit score frequently. Creditpicks allow you to do this for FREE through its partnership with TransUnion®.

Subscribe to our blog, and you’ll receive an automatic response email with a unique code to access TransUnion® CreditView. Your subscription is valid for one year.

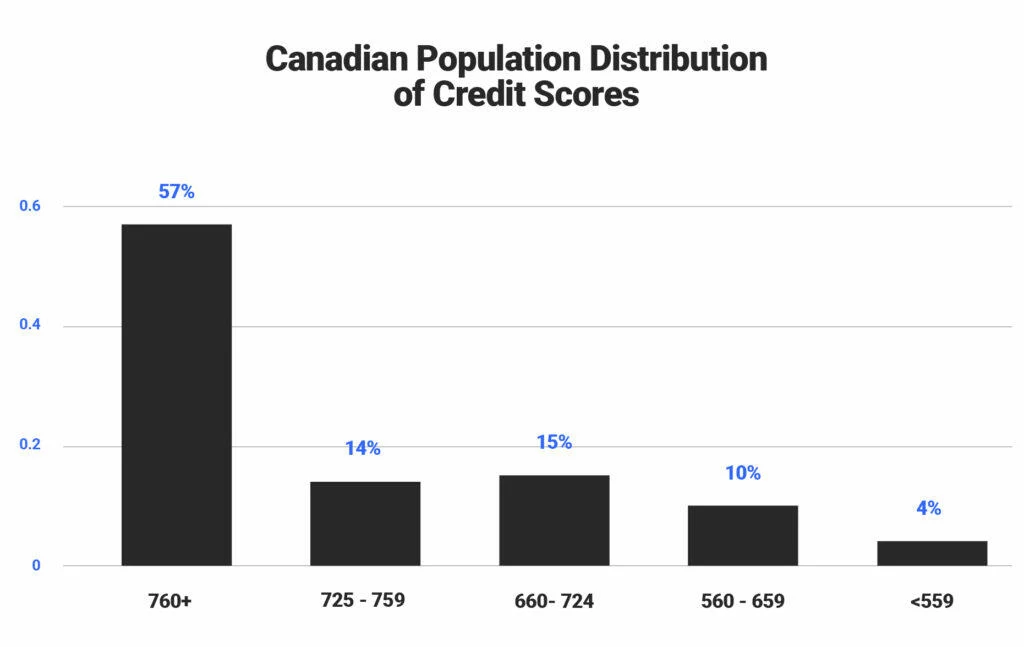

A Breakdown of Credit Scores in Canada

A good credit score in Canada is generally 660 or higher. An excellent credit score is broadly considered to be 750 or more. While maintaining a score above 800 is challenging, it is achievable with patience, financial responsibility, and maturity.

If you have a credit score under 660, it is still possible to obtain new credit if you have a good debt-to-income ratio. However, if your score is below 560, you can expect you will need a co-signer for any new borrowing. You may also be subject to a higher Annualized Percentage Rate (APR) and additional lender fees. Your application may also be rejected if it does not meet the creditor’s lending parameters.

Good Credit, Bad Credit, and Credit Repair

While you may be at a disadvantage if you have a less-than-perfect or low credit score, the good news is that it is reversible.

The first step is to check your credit score for free and set up credit monitoring on your account. If you enable alerts on your account, you will receive a notification every time there is a change on your credit report. These alerts include notice of:

Change in the overall score

Change of address or employment details

New inquiries (individual “hard” credit checks) on your account

Account payments and current balances

Late payments and other adverse actions

Information regarding any related public records

While you may be at a disadvantage if you have a less-than-perfect or low credit score, the good news is that it is reversible.

The first step is to check your credit score for free and set up credit monitoring on your account. If you enable alerts on your account, you will receive a notification every time there is a change on your credit report. These alerts include notice of:

5 Key Components of Your Credit Score

Payment History

~35%Without a doubt, your history of on-time payments is the most crucial aspect of your credit score. In addition, prospective lenders want to know the likelihood of you paying back your borrowed obligations.

This payment history encapsulates all payments on your consumer debt, such as credit cards, other revolving credit, and term loans. It also shows how many past due payments you have, any obligations in collections, and additional negative information such as declared bankruptcy.

Used versus Available Credit

~30%The cumulative total of your outstanding debt is also essential to your credit score. If you have a credit card or revolving line of credit that has historically been close to maxed out, that represents a higher risk for lenders (e.g., a lower credit score).

For example, consider two people who each charge about $4,000 every month on their credit card. However, one person has a $5,000 credit limit, while the other has a $10,000 credit limit. In this scenario, the person with a $5,000 limit represents a higher credit risk than the person with a $10,000 limit, as any unexpected reduction in income may hamper repayment ability.

Length of Credit History

~15%Your length of credit history provides clarity on how long your credit accounts have been active. A short credit usage timeline is typically not enough to determine the responsibility of a borrower. In addition, an extended credit history allows for greater visibility of repayment histories and the borrower’s overall commitment level.

It is important to note that your credit history will be affected if you have been involved in a bankruptcy, consumer proposal, or debt management program. A corresponding note will be placed on your account for at least two years after you repay your debts or complete the program. You’ll also likely need to focus on advanced credit repair techniques (e.g., requesting the removal of negative entries on your credit report).

New Inquiries

~10%Lenders conduct a credit check every time a borrower applies for a credit product. Therefore, if a borrower repeatedly applies for new credit, it may indicate they face financial challenges.

This credit score component tracks the number of times your credit has been checked in the last five years, the number of credit accounts currently open, and the timing of your recent “hard” credit checks.

Public Records

~10%Persons with a history of bankruptcy or collections will find these events drag down their credit score. Remember that bankruptcies stay on your credit report for approximately six or seven years after discharge. Carefully weigh your financial options if you’re ever considering bankruptcy.

Types of Credit

n/aCredit bureaus also take into consideration the type of credit you carry. For example, a consolidation loan may indicate that you have had trouble paying off debts in the past. On the other hand, a simple term loan with fixed repayment schedules demonstrates a lower risk profile.

Now that you know what goes into your credit score, let’s discuss what you can do to repair and elevate it.

Credit Repair and How to Enhance Your Credit Score

Remember that your credit report and score are your responsibility only. What you get out of it is based on what you put into it. This perspective means that you need to be personally responsible for your credit. No exceptions.

Develop a Clear Financial Plan

You can develop a financial plan by creating a monthly spreadsheet that lists all your income, debts, and expenses in one place. This “on paper” approach allows you to see your cash inflows and outflows and budget accordingly to repay debts.

Unfortunately, most Canadians who operate without a budget find they drastically underestimate their expenses each month. This underestimation leaves them in an unfavourable position when trying to pay down credit cards and other outstanding credit balances.

If you don’t feel comfortable creating a spreadsheet, try a personal budgeting app such as Mint or YNAB. These apps are highly rated and can help you reach your budgeting goals.

You should always have more money coming in than going out each month.

Discipline

The most financially stable borrowers do not necessarily earn the highest income. Instead, they are those who are the most disciplined with their spending.

For example, if you pay down a credit card by $250 one month, try not to spend $250 in the same month or be right back at square one. The best thing to do is wait another month, pay down another $250, and reward yourself with $100 in discretionary spending. You have now paid a net of $400 on your card account.

A disciplined repayment schedule consistently pulls you further out of debt and, as you may have guessed, positively impacts your credit score.

Hard versus Soft Inquiries

Hard inquiries are generally required when lenders review your entire credit report to determine eligibility for a new credit product. Soft inquiries are more of a “surface-level” look at your credit report and history.

When shopping for credit products, it is crucial to ensure that only soft inquiries are used. When you find the product you are looking for, any hard queries will temporarily decrease your overall score.

If you review your credit score and see credit inquiries over two years old, you can contact the responsible credit bureau to have them removed. These removals might not happen overnight; removing an aged credit inquiry takes 6-8 weeks. Both credit bureaus have emails, forms, and support dedicated to this function. You can access them here.

Don’t Cancel Your Oldest Credit Card

If you realize you have too many open credit cards, charge cards, or retail credit cards available, it is worth cancelling the ones you don’t use. But keeping your oldest card open is beneficial because it maintains a more extended credit history in your report.

Contact a Company Specializing in Credit Repair and Debt Management

Credit repair work is generally not easy, and experienced professionals can help fix your credit. Over the past few years, businesses specializing in helping consumers address negative credit impacts have become more prevalent.

While you may have to pay for this service, these businesses have in-depth knowledge of each credit bureau and its inquiry removal and dispute processes. This experience is especially helpful when you need negative items removed from your credit report.

Be wary when deciding whether or not to work with a credit repair agency. The service will likely require that you pay an upfront “setup fee” and ongoing monthly fees. Doing some research will ensure you don’t sign up for one of the many credit repair scams online that can also result in identity theft.

Remember that the first step to repairing your credit is accessing your free credit score. To do so, subscribe to Creditpicks’ blog.

Credit Repair is Real… to a Point

Some websites state that credit repair is not real. The truthful answer to this question is they’re both right and wrong. Credit repair services sell advanced credit repair strategies. The effectiveness of these strategies depends on each customer’s credit file. No one size fits all in this instance.

A good credit repair company will provide you with the following:

Free access to your credit report with a credit monitoring capability

An in-depth review of your credit file coupled with a comprehensive staged credit repair strategy

Personal tasks you need to accomplish (e.g., paying down specific bills, closing certain accounts)

Company tasks they need to complete (e.g., contacting credit agencies to remove aged inquiries or to dispute inaccurate information)

Detailed tracking of your credit score when you started the program, what actions were taken by you and the company, and ongoing results

Credit Repair Assistance is a Matter of Convenience

Using a credit repair service is about how much involvement you want in the process. You’re essentially paying for the convenience of the company performing the technical work (e.g., contacting the credit bureaus on your behalf). Remember that you can do all of the above on your own.

Unfortunately, credit repair ads can be misleading. So be sure to perform appropriate due diligence before hiring an advanced credit repair service in Canada.

Neo Secured Card

Did you know that one way to repair or build your credit score is to use a secured credit card? One such card in Canada is the Neo Secured Card, which offers a one-to-one credit limit to your security deposit. If you add $50 to your security deposit, your credit limit will be $50. Likewise, if you add $500, your new credit limit is $500. It’s that simple.

How does this help your credit score? The new card account and every payment are reported to the credit bureaus, meaning you build your credit score through on-time payments and credit history. There is no hard credit check, no annual fees, and the Purchase Credit Rate / APR is 19.99-24.99%, depending on your application, profile, and province.

If you’re looking to improve your credit score, the Neo Secured Card is a suitable and effective option available in Canada. And remember, you can always transition to an unsecured card once you have a higher credit score.