Payday loans are a popular financial solution for many Canadians who need a quick cash advance. A payroll loan might be the perfect option for an emergency or an unexpected expense. Or, you may need extra cash to tide you over until your next paycheck.

However, with many available options, choosing the best payday loan can take time and effort. You must remain cautious about interest rates, repayment terms, and the potential to get stuck in a payday loan cycle.

Factors to consider when choosing a payday loan provider

Only take on cash advance debt as you have to.

Creditpicks

Tweet

There are various factors you need to consider when choosing a payday lender. These factors include loan amounts available, interest rates and fees, repayment terms, and potential penalties.

Determining the loan amount and applying

First, you need to consider how much you need to borrow. Determine the maximum loan amount offered by different lenders. But keep in mind that payday loans are for short-term emergencies only.

Consider whether the loan will meet your short-term financial needs. Also, evaluate whether the loan amount matches your ability to repay. You can qualify without a credit check and even with a bad credit score.

The application process and loan approval are typically fast. You provide personal details such as your government-issued identification and proof of income as a part of the online application. Funds are then transferred to your bank account by INTERAC e-Transfer. You can also opt for a cheque or other type of funds transfer.

You may borrow up to $1500. But remember, taking out a $300 loan for 14 days might be all you need. Only take on cash advance debt as you have to.

Interest rates and fees

Compare interest rates offered by different short-term lenders. Consider whether the interest rate is fixed or variable and compare various lenders' rates and fees.

Borrowing under a payday loan can be expensive. And if you don’t read the loan terms, the total payback amount might be much higher than expected. Canada has passed laws regarding payday loans and their maximum allowable cost. Each province also has its regulations.

Repayment terms

Cash advances are typically short-term personal loans. You may have up to 62 days to repay the loan. But it is your interest to repay the loan as soon as possible. Even the best payday loans are known for their high-interest rates.

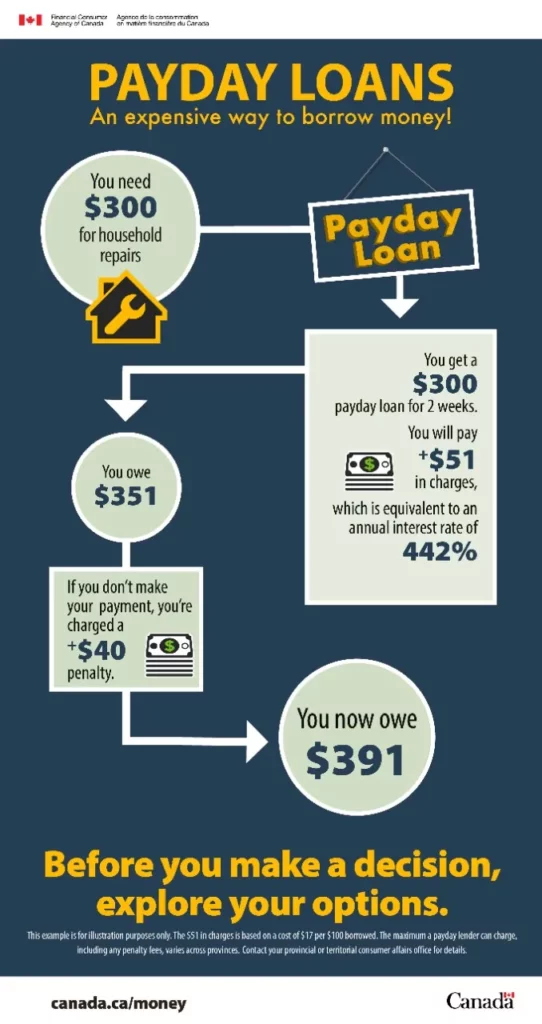

For example, a $300 loan will cost you 17%, or $17, for every $100 you borrow for 14 days. That is equal to a 445% annual interest rate. The borrowing cost is much lower if you can access a credit card cash advance, line of credit, or bank overdraft protection.

The following Government of Canada infographic summarizes potential payday loan interest rates.

Remember, your repayment terms might include additional fees. You should also review penalties for early repayment, late payments, and non-payment. These penalties generally carry heavy fees and can push you further into debt.

Ensure you set up a direct debit for your repayment. So when you receive your work income deposit, your loan repayment is immediately sent to the lender. Look for flexibility with your chosen lenders and compare their terms, interest rates, fees, penalties, and repayment options.

The best pay loans in Canada

It is important to remember that payday loan providers typically only operate in some provinces. The following are some of the most reputable short-term lenders in Canada.

iCash

- Approval process: Bad credit is okay, 24/7 approval and e-Transfer

- Amount: Up to $1500

- Interest rates: Varies depending on the province

- Terms: Minimum 7 days, up to 62 days

iCash has become one of Canada's most prevalent payday lenders. You can borrow money entirely online via their website or mobile app. There is no paperwork, 24/7 approvals and e-Transfer services, and no credit score is refused. iCash offers highly flexible repayment options to suit nearly any financial situation.

Cash Money

- Approval process: Bad credit is okay, instant approval, fast e-Transfer

- Amount: Up to $1500

- Interest rates: Varies depending on the province

- Terms: Minimum 5 days, up to 40 days

Cash Money offers more flexibility than traditional finance institutions. In addition to providing instant payday loans, they also offer personal loans up to $10,000. You can easily apply online or visit one of their stores across Canada. These stores also offer Western Union money transfer services.

GoDay

- Approval process: Bad credit is okay, instant approval, fast e-Transfer

- Amount: Up to $1500

- Interest rates: Varies depending on the province

- Terms: Up to 62 days

GoDay has been in the Canadian cash advance business since 2012. With a customer-centric approach, they promote responsible lending while offering the convenience of instant loan approval. They have a great Finance 101 page covering payday loans.

Money Mart

- Approval process: Instant approval, no credit check requirement

- Amount: $120, up to $1500

- Interest rates: Varies depending on the province

- Terms: Up to 62 days

If you live in Canada, you have seen a Money Mart store somewhere along the way. Money Mart is in nearly every reasonably-sized town and city across the country. Money Mart has been a Canadian staple since 1982. In addition to pay lending, they also offer personal loans up to $15,000, credit cards, and Western Union transfer services.

Tips for responsible borrowing

Taking out any loan is a big responsibility, especially a cash advance. Here are some tips for smart borrowing.

- Assess your financial situation and borrow only the amount necessary. Avoid the temptation to borrow more than you can afford to repay.

- Payday loan agreements can be complex. Read the terms and conditions carefully. Some payday loans have “cooling off” periods where you can immediately return the funds if you decide against taking out the loan. Pay attention to interest rates, repayment terms, and any additional fees or charges, such as those for non-sufficient funds (NSF) and returned cheques.

- Create a repayment plan by developing a budget and determining how you will repay the payday loan. Prioritize loan repayment to avoid falling into a cycle of debt.

What is the best payday loan service?

The best payday loans in Canada include the following:

- No credit check or accepts bad credit.

- Immediate approval and instant funding via e-Transfer.

- Reasonable repayment terms.

- Low interest rates and minimal penalties.

- Flexible repayment terms.

You should only consider a payday loan in an emergency. You will save significant interest charges if you can use a bank overdraft, credit card cash advance, or access a line of credit. This is especially true if you are late repaying the loan.

What are the safest payday loans with bad credit?

The safest payday loans with bad credit offer the lowest interest rates and highly flexible terms. However, speaking with a qualified credit counsellor might be a better option if you have a low credit score and significant debt. If you borrow money to pay another bill, a credit professional can help you organize your finances and lower your debt. This will have a positive impact on your credit score.

Payday loan alternatives

Here are some payday loan alternatives to consider:

- Friends and family. Though this may be uncomfortable, you can save some money with a short-term family or friends loan.

- Fairstone provides numerous loan products with great interest rates and terms. If you have decent credit, this is a good option for you.

- Spring Financial offers long-term loan products that might be useful for debt consolidation.

- Mogo offers payday loan alternatives with near-instant approval and funding.

Again, taking out a payday loan can become very expensive. Research your options before taking that financial leap of faith.

Conclusion

Choosing the best payday loan provider in Canada requires careful consideration of factors such as interest rates, repayment terms, and loan amount. By evaluating these factors and following responsible borrowing practices, you can make an informed decision and find a payday loan that meets your needs.

Remember to borrow only what you need and create a repayment plan to ensure a positive borrowing experience.

You can find numerous loan options on Creditpicks. We offer unbiased reviews of various cash advance products, ensuring you can make the best decision for your overall financial situation. Financial health is a part of your overall well-being. And you can always learn new habits. Check back often for more articles on payday lending and more.