Purchasing a car can be an exciting event, especially if it's the first one you ever owned. Unfortunately, not everyone can afford the full cost upfront. Therefore, it is crucial to find the best car loan rates in Canada to cover the cost of the car while still keeping finances in check.

Navigating car loan financing in Canada can be a challenge, as the loan cost may be substantially higher than the price of the car. However, with an understanding of the process and the correct information, you can successfully manage the complexity of car loan financing.

This article explains the steps needed to get a loan for a car in Canada. In addition, it provides guidance on the necessary conditions for approval, making obtaining financing for your desired vehicle straightforward.

Qualifying for a car loan in Canada

To be eligible for a car loan, you must fulfill specific requirements, regardless of which lender you decide to apply with.

Income

Getting a car loan largely depends on how much money you make, as lenders want to ensure you can repay it. Therefore, a consistent income will make you appear less risky to them, thus increasing your chances of being approved for the loan.

To be approved for a loan, the lender will need evidence that you have a steady source of income. They may also inquire about the total amount of debt you currently owe. Naturally, having fewer financial obligations will make your situation more favourable.

Credit score

The importance of your credit score in Canada cannot be understated when applying for an auto loan. It measures your reliability as a borrower regarding repaying money loaned to you.

A good credit score in the 680-900 is ideal, providing you with the best auto loan interest rates and terms. However, if your credit score falls between 300-680, it may be more challenging to secure financing for a vehicle, although this will depend on the lender.

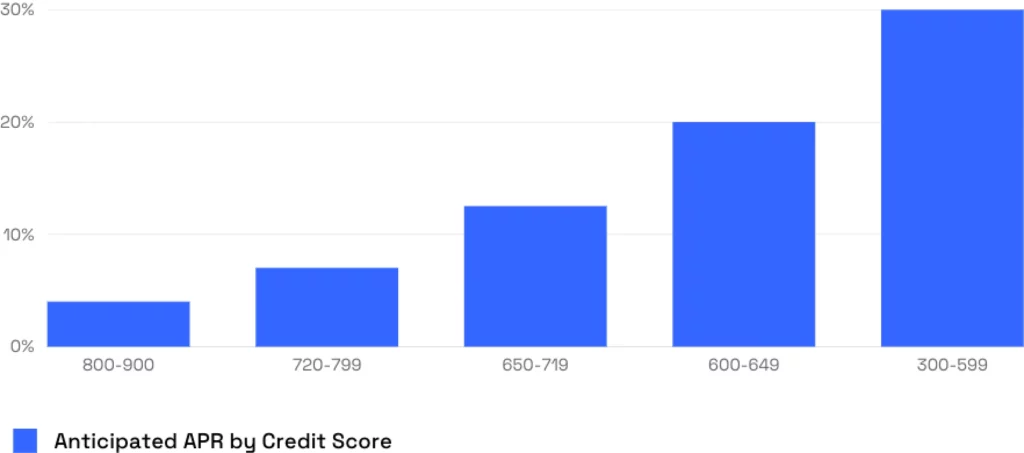

The amount of interest you pay for the loan for your car is determined by your credit score and could be similar to the chart shown.

Those with a less-than-stellar credit history may be asked to explain the events that led to the negative marks on their record and could require additional documentation to confirm their answers.

Debt-to-Income (DTI) ratio

Your regular debt payment amounts (such as mortgages, loans, and student loans) compared to your income is your debt-to-income (DTI) ratio. The DTI assesses how likely you are to repay your loans successfully. A higher DTI could decrease the chance of being approved for a loan.

Getting a car loan in Canada

When applying for a car loan, your credit score is the primary factor lenders use to assess your creditworthiness. However, other factors may come into play depending on your chosen lender. For example, some may look at your income, while others may be more strict in their loan terms. Ultimately, it all depends on who you get a loan from.

In-house car dealership financing

For those who don't have a great credit score, car dealerships can be a great way to buy a vehicle. In-house financing may be more expensive, but it can still be preferable to not being able to get a loan. Nevertheless, you'll unlikely get Canada's best car loan rates through this type of financing.

Rather than settling for the first dealership you come across, it's best to shop around and compare multiple dealerships' prices and interest rates. This will allow you to find the best rate that suits your needs.

Bank auto loans

If you have a less-than-perfect credit rating, dealing with banks can be difficult. Banks have very high requirements and strict standards for loan approval, making the process of getting a loan quite stressful.

However, banks offer some of the best interest rates on auto loans in Canada, but only if you have an excellent credit score. In contrast to dealerships which provide higher interest rates for those with poor credit, banks may deny the loan altogether.

Alternative lenders

Many people are in the same boat regarding having a low credit score and being unable to pay high-interest rates. However, the flexibility of certain financing options can be helpful for those on a tight budget, even if it means paying more than the car's original cost.

Other loan options

If you cannot find what you are looking for using the above resources, email us. We maintain preferential relationships with multiple loan servicing company. We will collect your basic information so a third-party financing representative can contact you shortly thereafter.

Loans for boats, ATVs, and other recreational vehicles

Getting a loan for a boat, ATV, or another type of recreational vehicle is the same as getting a car loan. These dealerships generally accept cash and bank loan financing a payment. They likely also have in-house financing at higher rates. If you're looking to get a four-wheeler, a side-by-side, or a new jet ski, expect a similar process for financing.

Average car loan interest rates in Canada

In 2024, car loan interest rates generally range of 4.5% to 10.0%, with an assumed average rate of around 7.0-8.0%.

Creditpicks

The average interest rate in Canada can fluctuate depending on current economics (and the Prime Rate set by the Bank of Canada), and in 2024 is usually in the range of 4.5% to 10.0%, with an assumed average rate of around 7.0-8.0%. However, with non-bank lenders, you could see interest rates of 29.0%+.

You can look it up here for an exact rate for a specific period.

Depreciation and negative equity

The value of a good can decrease over time due to various causes. For instance, a car can lose one-eighth to one-fourth of its worth annually. This decrease in value is known as depreciation.

When the value of a car decreases more rapidly than the loan payments made on it, negative equity can result. This can be problematic because it can create financial difficulties.

If you need to sell your car after a few years but still have an outstanding loan balance, the amount you receive for the vehicle (e.g. $18,000.00) may not cover the entire loan amount (e.g. $25,000.00).

As a result, you may need to borrow the difference ($7,000.00) from elsewhere. The following can help you avoid negative equity.

Pay a larger down payment

Making a large initial payment on a car ($5000.00 for a $30,000.00 vehicle) will reduce the amount of loan you need from the bank and give you a jump start on the car's value before it starts to decrease. Additionally, this could help you get a better interest rate and avoid owing more than the car is worth.

Pay off your car loan quickly

Shortening the loan term may help reduce the risk of getting into negative equity, as the car will depreciate less over a shorter period. To learn more about how to avoid negative equity, please click the provided link.

Negotiate the car loan rate

Negotiating to get the best car loan rates in Canada is essential. The less money that is going to interest, the better. A lower rate means you're paying off the principal value of the loan instead of interest, meaning you're always getting ahead of potential negative equity.

Summary

A bad credit score does not mean you won't get an auto loan. However, it could lower your chances of getting a loan. And, likely, you won't get Canada's best car loan rates. But you can improve your chances by lowering your debt-to-income ratio, having a solid payment history, and maintaining a reasonable credit score range.

Applying for a personal loan, or applying for credit in general, can be stressful. And the more you know about credit score models and the factors they consider, the better. Creditpicks gives you free credit score access through TransUnion when subscribing to our mailing list. When you access your TransUnion account, you can review your credit accounts, credit limits, payment history, and more.