Familiarizing yourself with the topic of self-employed health insurance in Canada can be quite challenging. It’s extremely important to understand, and with the right information and tools relevant to your situation, you can ensure you are making the right decision on your health insurance as a self employed individual. This article will provide you with information on the essentials of self-employed health insurance, potential tax deductibility, cost, different types of coverages, providers, and the role of online-only providers. This will help you maximize and get comprehensive coverage that fits your situation.

The Basics of Self-Employed Health Insurance

Self-employed individuals in Canada face unique challenges and opportunities when it comes to health insurance. Unlike employees who often receive health benefits through their employers, self-employed individuals need to secure their own health insurance, which can be a complex process. It’s important that you understand the different types of coverage available, including basic health plans that cover physician and hospital services and more comprehensive policies that include prescription medication, dental care, and vision care. Like most things, the more comprehensive, the more it’ll cost.

Tax Deductibility of Health Insurance for the Self-Employed

As a general rule of thumb, one of the significant advantages of being self-employed is the ability to deduct health insurance premiums for tax purposes in Canada paid to a private health services plan (PHSP) as long as certain conditions are met. Health insurance premiums can be deducted as a business expense, which can reduce your taxable income, resulting in less taxes paid. It’s important to keep detailed records of all health-related expenses. We recommend that you consult with a tax professional to ensure you meet all the conditions for the tax deduction and also to maximize your deductions under the Canadian Revenue Agency (CRA) guidelines.

Cost Considerations

The cost of health insurance for self-employed individuals in Canada will vary depending on several factors, including the level of coverage, the deductible chosen, your age, and your health status, just to name a few. Typically, basic plans are more affordable but offer limited coverage, whereas comprehensive plans come at a higher cost but provide extensive benefits. Comparing different plans and providers is essential to finding a policy that meets your needs and budget. Assess your overall situation and well-being, as you want the coverage to best fit your situation.

Exploring Different Types of Coverages

Health insurance plans for the self-employed can range from basic to comprehensive:

- Basic Coverage: Typically covers routine medical expenses such as: prescription medications, basic dental care, basic vision care, hospital services, physician services, medical equipment and more

- Extended Health Coverage: Typically this builds on the basic coverage and is more comprehensive and with higher limits.

- Disability Insurance: Provides financial support in the event that you’re unable to work due to illness, disability or injury.

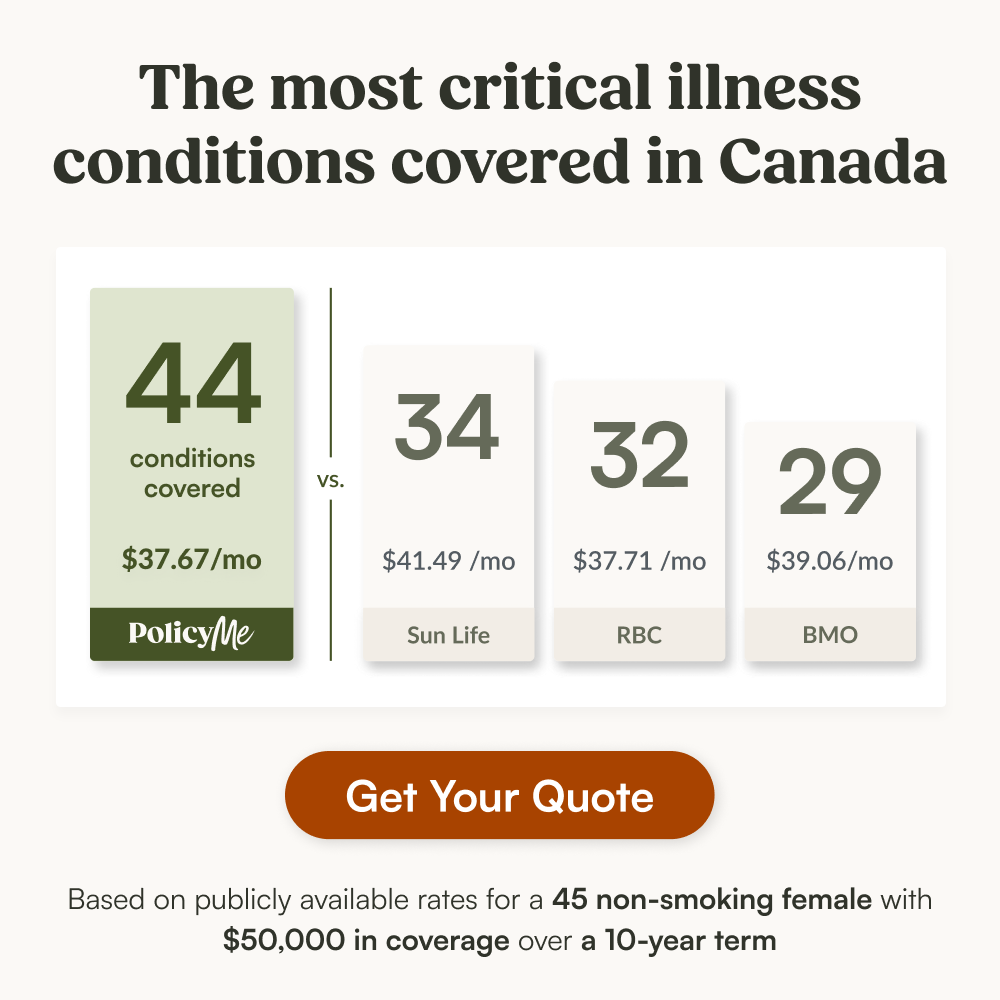

- Critical Illness Insurance: Offers a lump sum payment if you are diagnosed with a specified serious illness or medical condition.

You’ll want to make sure to assess your personal and family health needs when deciding on the type of coverage. Different providers and different health insurance plans may have coverages that differ from the above and from each other.

Choosing the Right Provider

Many health insurance providers in Canada offer plans tailored to the needs of self-employed individuals. Traditional insurance companies offer customizable packages, while newer, online-only providers are streamlining the process with digital-first solutions. PolicyMe, for example, allows you to easily compare different plans and apply online, providing a convenient and user-friendly approach to securing health insurance. Check out our article for an overview and a step by step guide on the applicable process.

The Role of Online-Only Providers

Online-only insurance providers have transformed the way self-employed individuals access health insurance. These platforms offer several advantages:

- Convenience: Apply for and manage your insurance online without needing in-person appointments.

- Cost-Effectiveness: Often lower overhead costs than traditional insurers, potentially resulting in lower premiums.

- Transparency: Easy comparison of different plans and coverages to find the best fit for your needs. You can easily adjust the type of coverage you’d like to see the difference in cost.

Online insurance providers are making it easier than ever for self-employed Canadians to understand, compare, and purchase health insurance that suits their budget and coverage requirements.

Conclusion

Self-employed health insurance is vital for freelancers, entrepreneurs, and anyone working independently in Canada. By understanding the tax advantages, assessing different types of coverage, and exploring both traditional and online-only insurance providers, you can find a plan that provides peace of mind and financial protection. With providers like PolicyMe, the process is more accessible and user-friendly, allowing you to focus more on your business and less on bureaucratic complexities.

Researching and choosing the right health insurance plan is an investment in your health and business. As we navigate the complexities of self-employed health insurance in Canada, remember that the right coverage can safeguard both your physical and financial well-being.

If you enjoyed reading this article, be sure to subscribe to Creditpicks for more personal finance content!